[ad_1]

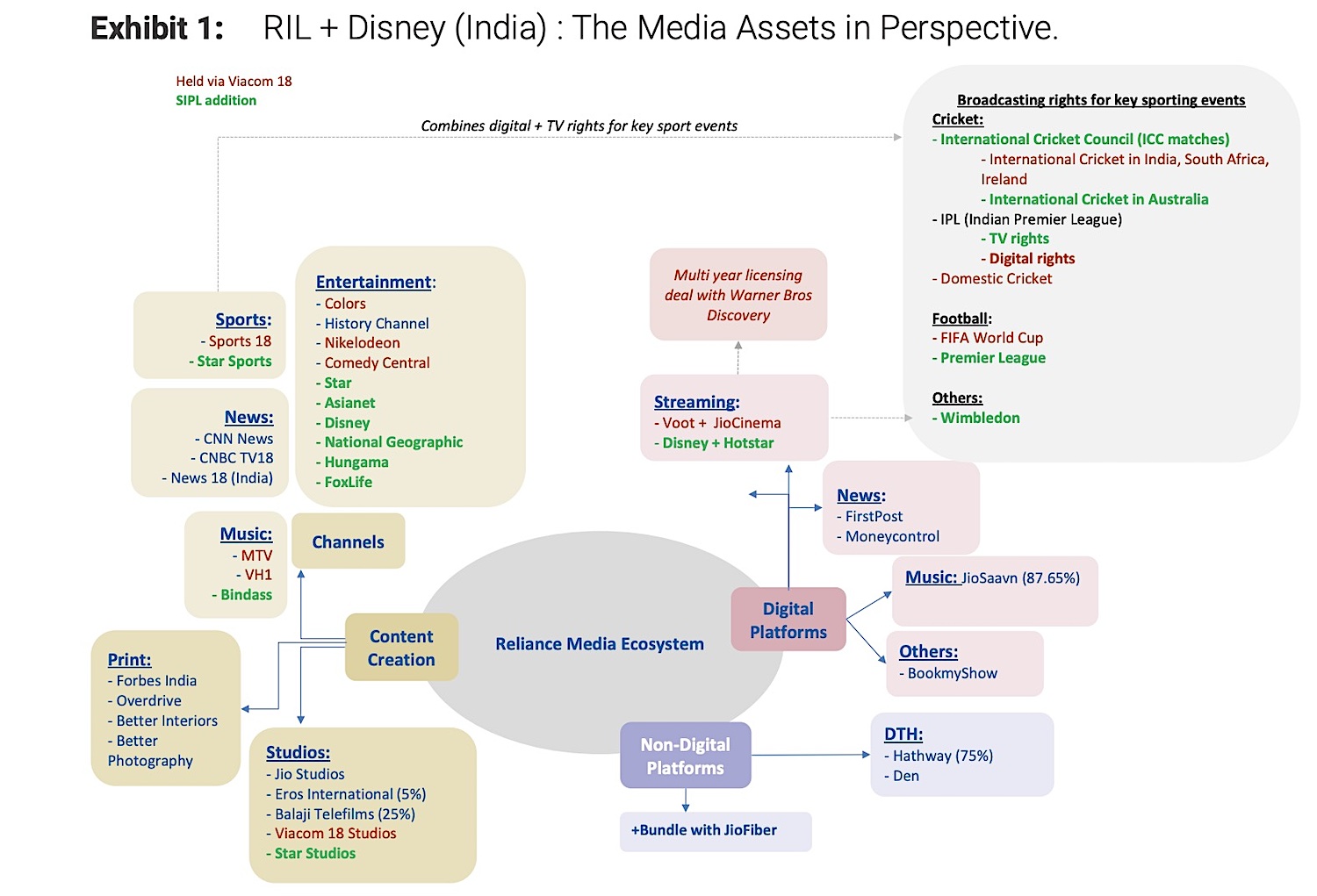

Reliance, its portfolio Viacom18 and Disney are merging their media companies in India, creating the most important media entity on the earth’s most populous nation. Reliance, which is able to management the three way partnership, immediately owns 16.34% of the merged entity, which it has valued at $8.5 billion. Disney will personal a 36.84% stake within the merged entity, and Reliance-backed Viacom18, which additionally counts Paramount International and James Murdoch’s Bodhi Tree amongst its backers, will personal 46.82% stake.

Reliance, which is India’s most precious agency, mentioned it sees a possibility to broaden and streamline its presence within the Indian fast-growing market by merging its media property with Disney India. Reliance, which owns about 75% of Viacom18, plans to speculate $1.4 billion into the three way partnership for its progress technique.

For Disney, the deal is bittersweet. The agency as soon as valued its India enterprise at about $16 billion and the streaming enterprise Hotstar, which turned a part of Disney India after the mega Fox acquisition, allowed the U.S. large to aggressively broaden into a number of Southeast Asian streaming markets.

Moreover, Disney disclosed in an SEC submitting Wednesday that the three way partnership will incur a non-cash pre-tax impairment of between $1.8 billion and $2.4 billion, “roughly half of which displays a write-down of the online property of Star India,” within the present quarter.

Picture: Morgan Stanley

The “strategic” merger of Reliance and Disney India additionally unites two main Indian streamers, JioCinema and Disney+Hotstar. The three way partnership additionally contains entry to dozens of TV channels that Disney owns and unique rights to Disney’s films and different productions in India, in addition to its 30,000 extra property. Between JioCinema and Hotstar, the merged entity may also be the digital residence to content material from HBO, Showtime and NBCUniversal.

The mixed unit will attain over 750 million viewers throughout India, the corporations mentioned. The brand new enterprise comes at a time when massive media giants are struggling in India. Sony referred to as off the merger between its India unit and Zee Leisure final month, ending a two-year acquisition deliberation that will have created a $10 billion media powerhouse within the South Asian market.

Reliance chairman Mukesh Ambani, who additionally occurs to be Asia’s richest individual, mentioned the take care of Disney “is a landmark settlement that heralds a brand new period within the Indian leisure trade.”

He added: “We now have at all times revered Disney as one of the best media group globally and are very excited at forming this strategic three way partnership that may assist us pool our intensive sources, inventive prowess, and market insights to ship unparalleled content material at inexpensive costs to audiences throughout the nation. We welcome Disney as a key accomplice of Reliance group.”

The merger follows a fierce competitors between Hotstar and JioCinema, which lured high Disney expertise final 12 months to spice up its platform. Viacom18 additionally outbid Disney’s $3 billion for five-year streaming rights to India’s fashionable cricket match, the Indian Premier League, breaking a lot of Hotstar’s previous viewing data in only one 12 months. Disney paid the identical quantity for the TV rights. To lure customers, each the corporations have been streaming a lot of their catalogs for gratis in India.

The mixed new entity captures each digital and TV rights of key cricket sporting occasions in India, like IPL and ICC matches. The 2023-27 IPL broadcasting now sit below the JV – Viacom18 has digital streaming rights whereas Star has TV broadcasting rights.

Disney CEO Bob Iger mentioned the three way partnership will “create long-term worth for the corporate.” He added: “Reliance has a deep understanding of the Indian market and shopper, and collectively we’ll create one of many nation’s main media corporations, permitting us to higher serve customers with a broad portfolio of digital companies and leisure and sports activities content material.”

The merger additionally reunites former Star India CEO Uday Shankar and James Murdoch with the enterprise they beforehand constructed for a decade — Shankar departed Star India after 2020 disputes with Disney; then he and Murdoch launched Bodhi Tree, an India media funding automobile backed by $1.7 billion from Qatar Funding Authority, which invested over $500 million in Viacom18. Shankar now returns as vice chair of the merged entity’s board.

The merger is topic to regulatory and shareholder approval and the 2 corporations count on it to finish by the tip of March 2025.

The story was up to date all through with extra particulars.

[ad_2]