[ad_1]

Indian meals supply startup Swiggy is reducing about 400 jobs, or almost 7% of its workforce, because the startup seeks to convey additional enhancements to its funds forward of a deliberate IPO later this 12 months.

That is the second spherical of layoff on the Bengaluru-headquartered startup, which minimize simply as many roles early final 12 months.

The transfer comes as Swiggy makes an attempt to additional enhance its funds. Although its meals supply enterprise has been worthwhile for a number of quarters, the startup just isn’t worthwhile at a bunch stage. Zomato, Swiggy’s chief rival, turned worthwhile final 12 months.

Funding bankers and mutual fund buyers maintain the view that Swiggy shall be very carefully in comparison with Zomato by retail buyers on the time of itemizing and must beat the older rival on many metrics if it wishes valuation.

Swiggy didn’t reply to a request for remark. Indian newspaper ET first reported the layoff.

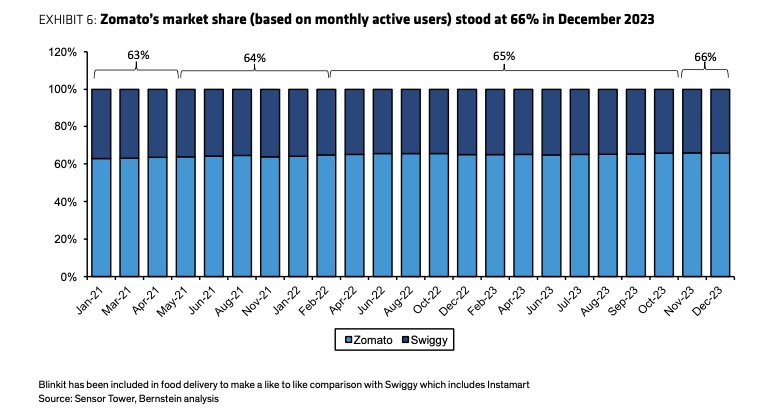

Zomato and Swiggy lead the Indian meals supply market, however in current quarters Zomato has expanded its market share lead, in line with UBS and AllianceBernstein. Zomato held over 60% of the Indian meals supply market, primarily based on app person depend, AllianceBernstein mentioned in a observe Wednesday.

Knowledge, picture: AllianceBernstein

“Submit covid, Zomato has grown quicker than Swiggy — each from a person base & GMV perspective pushed by robust execution, wider penetration (Zomato is current in 750+ cities as in comparison with ~600 cities for Swiggy) and stronger content material funnel,” AllianceBernstein analysts wrote.

“Up to now three months, Zomato has incrementally gained ~100bps in market share when it comes to month-to-month energetic customers (MAUs). From a GMV perspective, Zomato holds ~54% share in meals supply as in comparison with Swiggy at 46% as of 1HCY23, Zomato’s meals supply GMV stood at $1.7Bn as in comparison with Swiggy’s $1.4Bn. Zomato has been a gainer in Tier 2+ cities in addition to some Tier 1 cities — which has led to a better MAU base for Zomato. Zomato had 58Mn annual transacting customers in CY22, with meals supply phase exhibiting18.4Mn MTUs in Q2FY24.”

[ad_2]