[ad_1]

The Nationwide Funds Company of India (NPCI), the governing physique overseeing the nation’s broadly used Unified Funds Interface (UPI) cellular cost system, is about to have interaction with numerous fintech startups this month to develop a method to handle the rising market dominance of PhonePe and Google Pay within the UPI ecosystem.

NPCI executives plan to satisfy with representatives from CRED, Flipkart, Fampay and Amazon amongst different gamers to debate their key initiatives geared toward boosting UPI transactions on their respective apps and to know the help they require, individuals acquainted with the matter instructed TechCrunch.

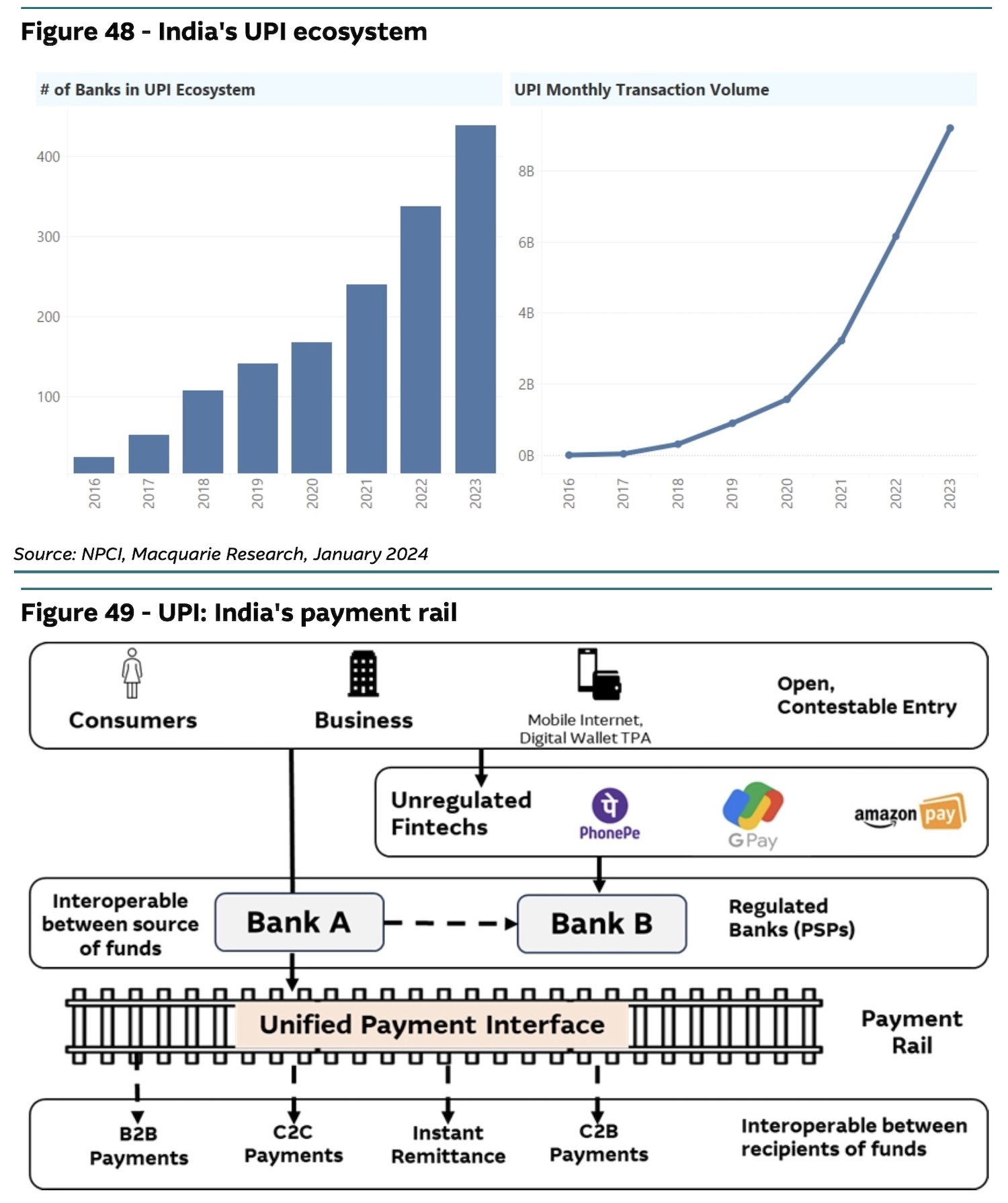

UPI, constructed by a coalition of Indian banks, has turn out to be the preferred method Indians transact on-line, processing over 10 billion transactions month-to-month.

The brand new conferences are a part of an rising effort to handle considerations raised by lawmakers and trade gamers relating to the market share focus of Google Pay and PhonePe, which collectively account for almost 86% of UPI transactions by quantity, up from 82.5% on the finish of December. Walmart owns greater than three-fourths of PhonePe.

Paytm, the third-largest UPI participant, has seen its market share decline to 9.1% by the top of March, down from 13% on the finish of 2023, following a clampdown by the Reserve Financial institution of India (RBI).

An outline of India’s UPI ecosystem. (Picture: Macquarie)

The dialog follows the central financial institution expressing “displeasure” to the NPCI over the rising duopoly within the funds house, an individual acquainted with the matter mentioned. An NPCI spokesperson declined to remark.

In February, a parliamentary panel in India urged the federal government to help the expansion of home fintech gamers that may provide options to the Walmart-backed PhonePe and Google Pay apps.

The NPCI has lengthy advocated for limiting the market share of particular person corporations taking part within the UPI ecosystem to 30%. Nonetheless, it has prolonged the deadline for companies to adjust to this directive to the top of December 2024. The group faces a singular problem in implementing this directive: It believes that it at present lacks a technical mechanism to take action, TechCrunch beforehand reported.

The RBI can be weighing an incentive plan to create a extra favorable aggressive discipline for rising UPI gamers, one other individual acquainted with the matter mentioned. Indian each day Financial Occasions individually reported Wednesday that the NPCI is encouraging fintech corporations to supply incentives to their customers, selling the usage of their respective apps for making UPI transactions.

[ad_2]