[ad_1]

Normal Catalyst, one of many largest U.S. enterprise capital corporations, is in talks to amass an India-focused VC as a part of efforts to increase its presence within the fast-growing South Asian startup market, three sources accustomed to the matter advised TechCrunch.

The deal would permit Normal Catalyst to faucet deeper into India’s vibrant know-how scene that has lured over $100 billion in startup investments since 2010. TechCrunch couldn’t establish the goal fund, however understands that it’s a sub-$200 million AUM store. The deal hasn’t finalized, so issues could change, the sources cautioned, requesting anonymity because the deliberation is non-public.

Normal Catalyst has backed a few dozen and a half startups in India — together with fintech big CRED, used automotive market Spinny, and healthtech Orange Well being — however the enterprise agency has been seeking to considerably increase its presence within the nation for greater than a yr, a number of individuals accustomed to the matter mentioned. It didn’t reply to a request for remark.

The U.S. agency held conversations with many senior people in India final yr seeking to discover an India-based associate, many individuals accustomed to the matter mentioned. Sooner or later final yr, it additionally started evaluating the potential of buying an India-focused fund and use that route to ascertain a broader presence within the nation, the individuals mentioned.

The agency, which has over $25 billion in property below administration, plans to speculate greater than $500 million in India over the following three to 4 years, one other individual accustomed to the matter mentioned. Its new give attention to India follows the agency increasing in Europe final yr by agreeing to merge with La Famiglia, an investor in a number of high-profile early-stage startups together with AI agency Mistral.

India, one of many world’s largest startup ecosystems, has attracted a number of heavyweights together with Sequoia, Lightspeed, Accel, Tiger World, SoftBank, and Perception Companions prior to now decade and a half. Plenty of different high-profile enterprise corporations together with Coatue Administration and QED and Andreessen Horowitz have additionally backed Indian startups lately as they choose younger corporations trying to serve the quick rising web market of over 700 million customers.

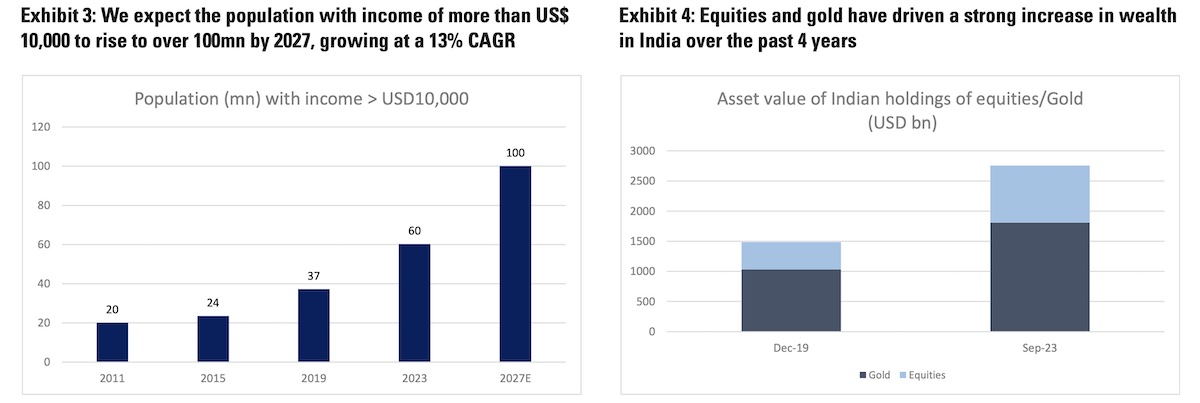

Goldman Sachs’ projection for India. (Picture: Goldman Sachs)

Investing in India has confirmed uniquely difficult to many world enterprise corporations which have entered the nation or have explored such risk, a associate at a India-based enterprise agency mentioned. “India has immense potential however we don’t but have the extent of exits you see within the U.S., nor do now we have the scale of returns you would possibly discover elsewhere,” the investor mentioned, cautioning that enterprise corporations have to make peace with the truth that the time horizon wanted for greater payday is for much longer in India.

But, globally funds — together with asset managers — are more and more increasing give attention to India, whose $4 trillion GDP is anticipated to double by the top of the last decade, in keeping with Morgan Stanley. Invesco, T. Rowe Value, BlackRock, Constancy and UBS are more and more investing in Indian startups via their mutual funds.

“Fairly than excited about common GDP take a look at what number of households in India will make greater than $50,000 to $75,000 a yr by 2030. Our asset is builders,” Anu Hariharan, founding father of VC agency Avra and previously the pinnacle of YC Continuity, posted on X final week.

“India may have ~15 million builders within the subsequent decade making $50,000 to $75,000 a yr. For each developer family, there’s a monetary companies family and a healthcare family that may also make $50,000 to $75,000 a yr. That equates to ~45 million households (that can make greater than $60,000 a yr by 2030.) Compared the UK at the moment has 28 million households making $45,000 a yr.”

[ad_2]