[ad_1]

As we head into the New Yr, you is likely to be interested by making a funds for your self or you could be in search of a brand new device to assist handle your startup or small enterprise’s funds. Chances are you’ll be seeking to swap out your present budgeting app for a greater one, or maybe you’re somebody who has historically relied on spreadsheets. Though spreadsheets generally is a easy strategy to handle and monitor a funds, it might be value trying out budgeting apps to avoid wasting your self some effort and time. We’ve compiled two lists of apps that we predict are nice budgeting instruments for people and startups.

For people, budgeting app might help you lower your expenses by creating and sticking to a month-to-month funds. For startups and small companies, budgeting app might help you perceive your organization’s monetary well being and make knowledgeable choices. Whichever approach you go, the most effective budgeting app for you’ll rely in your particular person or enterprise wants, so we’ve included a wide range of apps that will help you discover one which works finest for you.

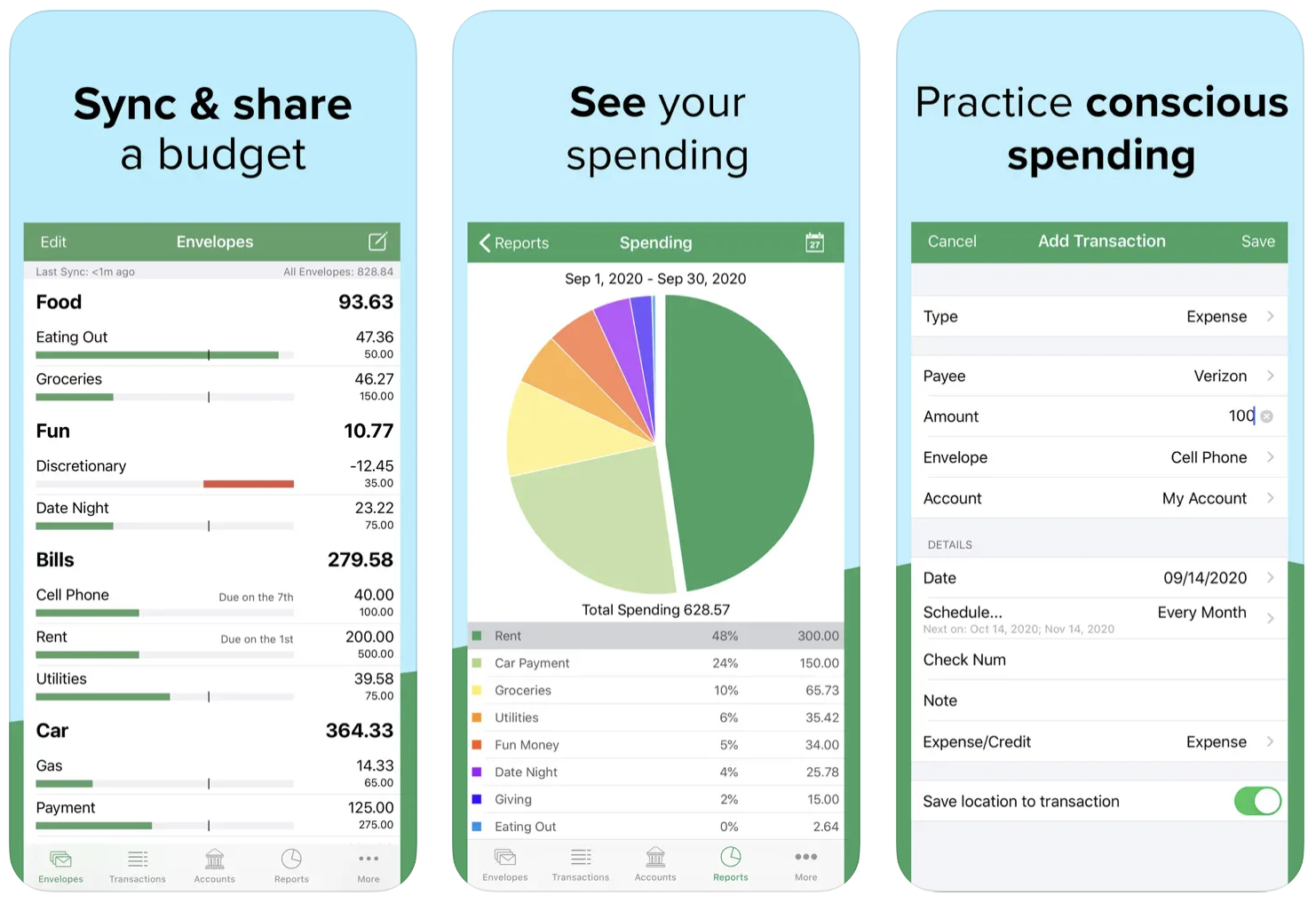

Goodbudget

Picture Credit: Goodbudget

Goodbudget is an effective app in case you’re a newbie and simply getting began out with budgeting. It makes use of the envelope system, which is among the authentic methods of managing cash. Goodbudget helps guarantee that you’re by no means caught off-guard by a invoice or sudden expense. Every month, you put aside cash for issues that you just want, like groceries and fuel. After getting put aside cash in your necessities, you’ll be able to then select how you can use the remaining primarily based on what’s vital to you.

The app can be a terrific possibility you probably have a shared family, because it permits you to sync your funds with one other individual. Goodbudget affords each a free model and a paid model, which prices $8 monthly. The free model consists of all the pieces you have to handle a funds, whereas the paid model offers you further capabilities, akin to e mail assist, limitless envelopes and the flexibility to make use of the service on 5 gadgets versus simply two. One doable draw back is that it’s a must to manually enter your transactions within the app, because the app doesn’t connect with your checking account.

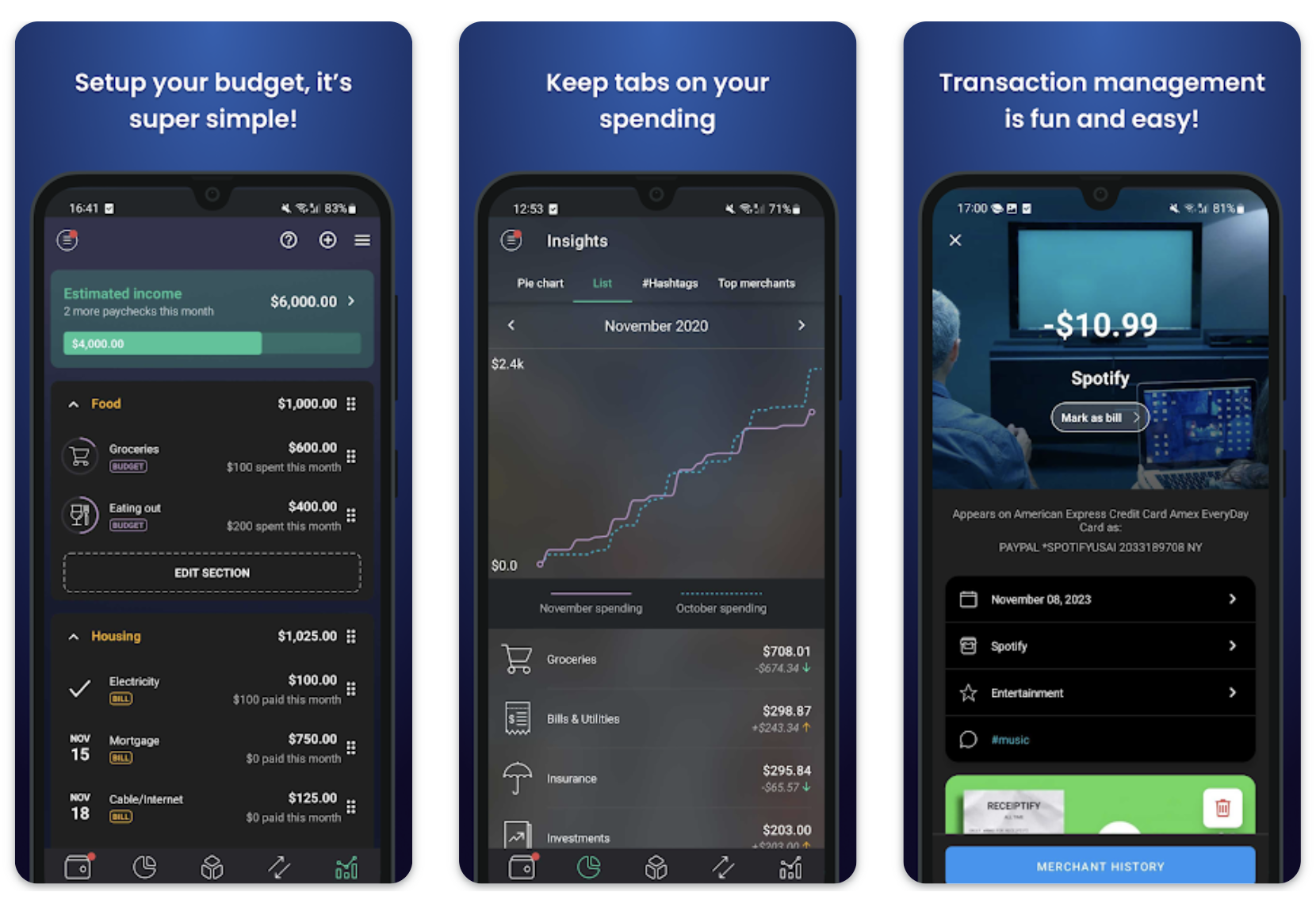

PocketGuard

Picture Credit: PocketGuard

In case your primary purpose is to trace your spending, PocketGuard is likely to be the most effective app for you. PocketGuard exhibits you the way a lot spendable cash you have got after you put aside sufficient in your payments, objectives and requirements. The app exhibits you a pie chart so you’ll be able to visualize which bills are taking on essentially the most cash. You may set spending limits within the app to be sure to’re not spending past your means.

PocketGuard hyperlinks your banks, bank cards, loans and investments in a single place so as to show you how to maintain monitor of your account balances, web value and extra. There’s a restricted free model of the app and a paid model, which prices $8 monthly and unlocks options like the flexibility to create your individual spending classes, set a debt payoff plan, connect receipts, export transaction information and extra.

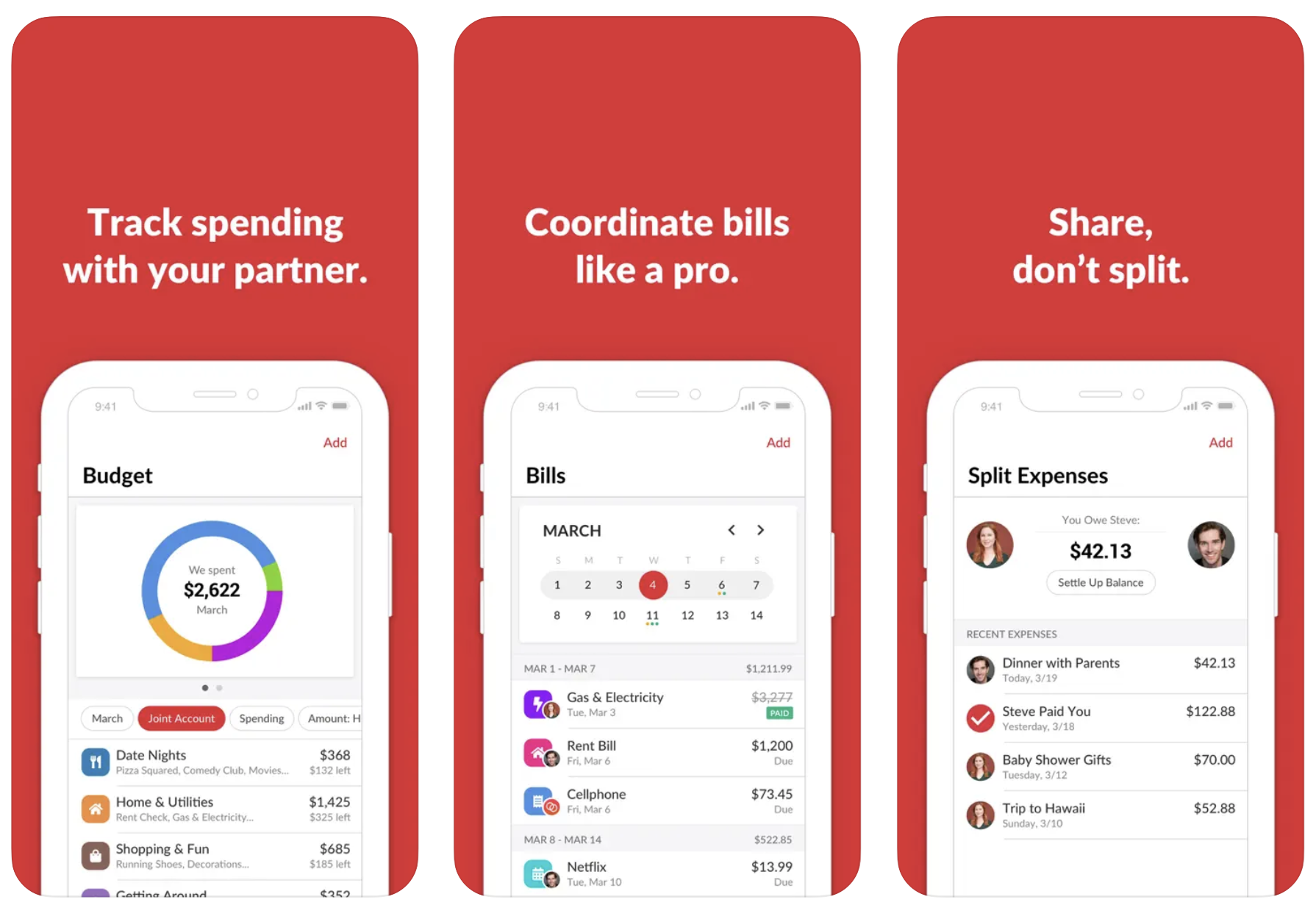

Honeydue

Picture Credit: Honeydue

Honeydue is an effective budgeting app if you wish to plan and handle your funds along with your associate. The app syncs to yours and your associate’s financial institution accounts. Honeydue permits you to handle your cash collectively whereas monitoring your bills and speaking about payments. You may chat along with your associate within the app and resolve whether or not one individual can be overlaying a invoice, or if the 2 of you’ll be splitting it evenly.

The app additionally affords its personal joint checking account. Honeydue is free to make use of, so it’s possibility for {couples} who don’t wish to pay a month-to-month subscription. One draw back is that there isn’t a desktop model of the app, so in case you’re somebody who likes to handle your funds on an even bigger display screen, Honeydue won’t be the most suitable choice for you.

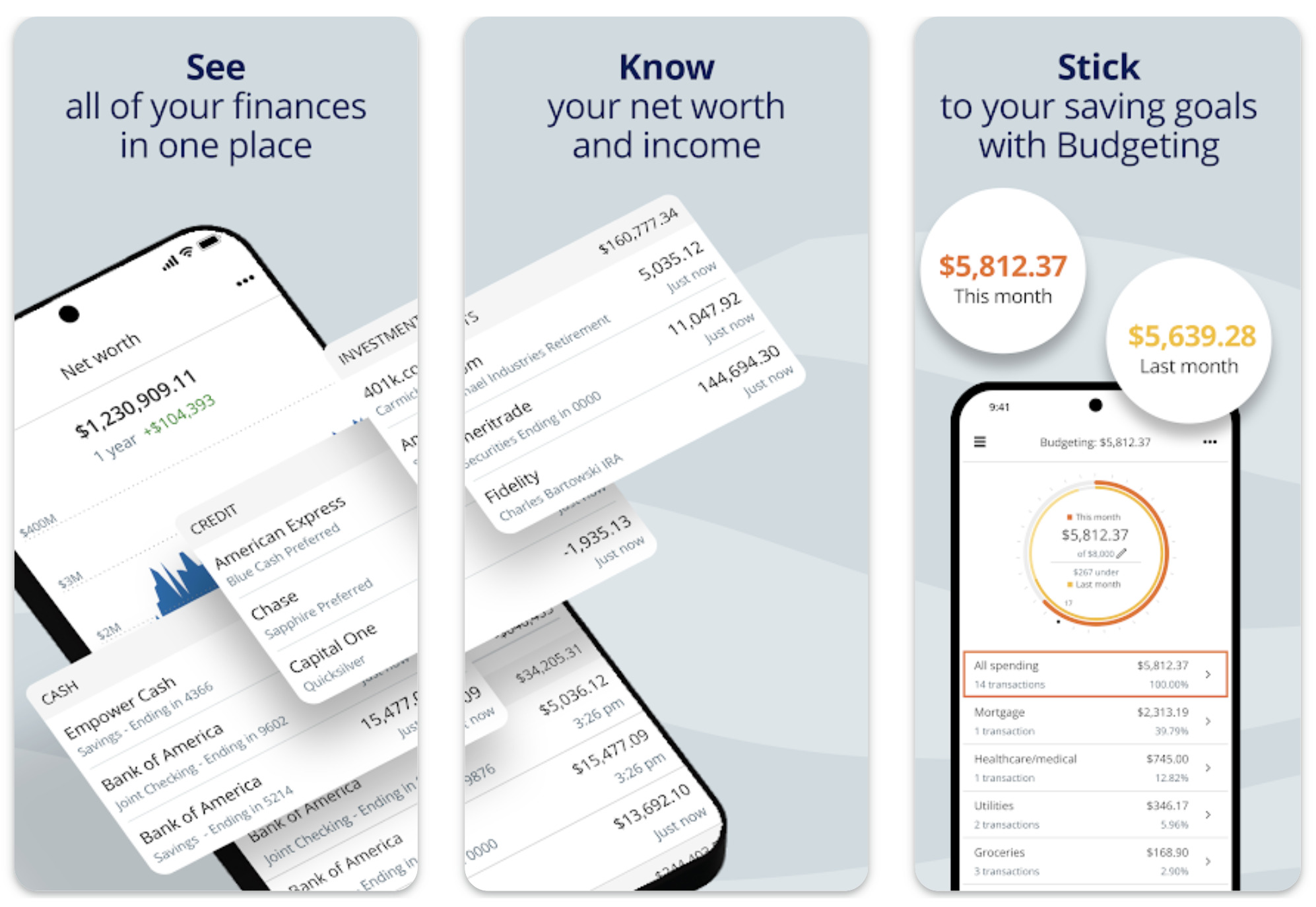

Empower

Picture Credit: Empower

Empower is an effective app if you would like a device for each budgeting and investing. The app permits you to monitor all of your accounts, together with your financial institution and bank cards, IRAs, 401(okay)s, mortgages and loans in a single place. You may plan for retirement, monitor your investments and uncover hidden charges. Empower encompasses a money-tracking dashboard that allows you to monitor your bills primarily based on classes.

The service is free to make use of and is designed that will help you handle each your day-to-day funds whereas additionally serving to plan for the long run. Nonetheless, in case your primary purpose is to funds your spending, Empower won’t be the most suitable choice for you. Chances are you’ll be higher off selecting a distinct app on this checklist as a result of Empower’s budgeting instruments aren’t as superior as a few of the different ones.

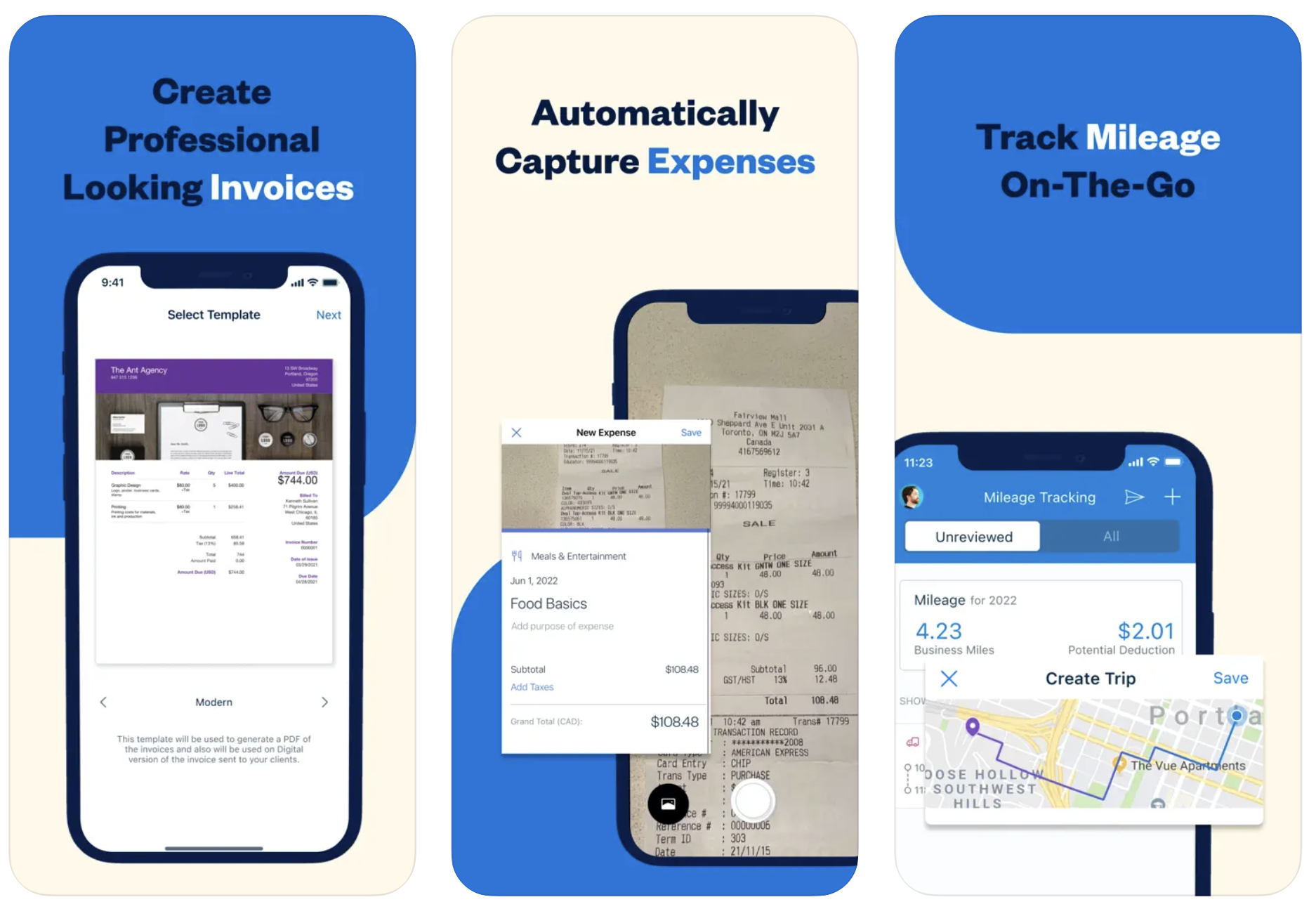

FreshBooks

Picture Credit: FreshBooks

FreshBooks is an easy device that may assist startups and small companies create a funds and persist with it. The service connects to your checking account or bank card to trace your bills. FreshBooks has instruments for invoicing, time monitoring, bookkeeping, funds and extra. It permits you to take receipt pictures, ahead e mail receipts to your account and import bills out of your checking account.

The service has instruments for companies in any respect phases, from freelancers to companies with a number of workers. FreshBooks permits your group, shoppers and contractors to collaborate and share recordsdata and updates in a single place. It may additionally combine with over 100 apps together with Dropbox, HubSpot, GSuite, Stripe and extra. FreshBooks has 4 pricing tiers, with its enterprise ones beginning at $30 monthly.

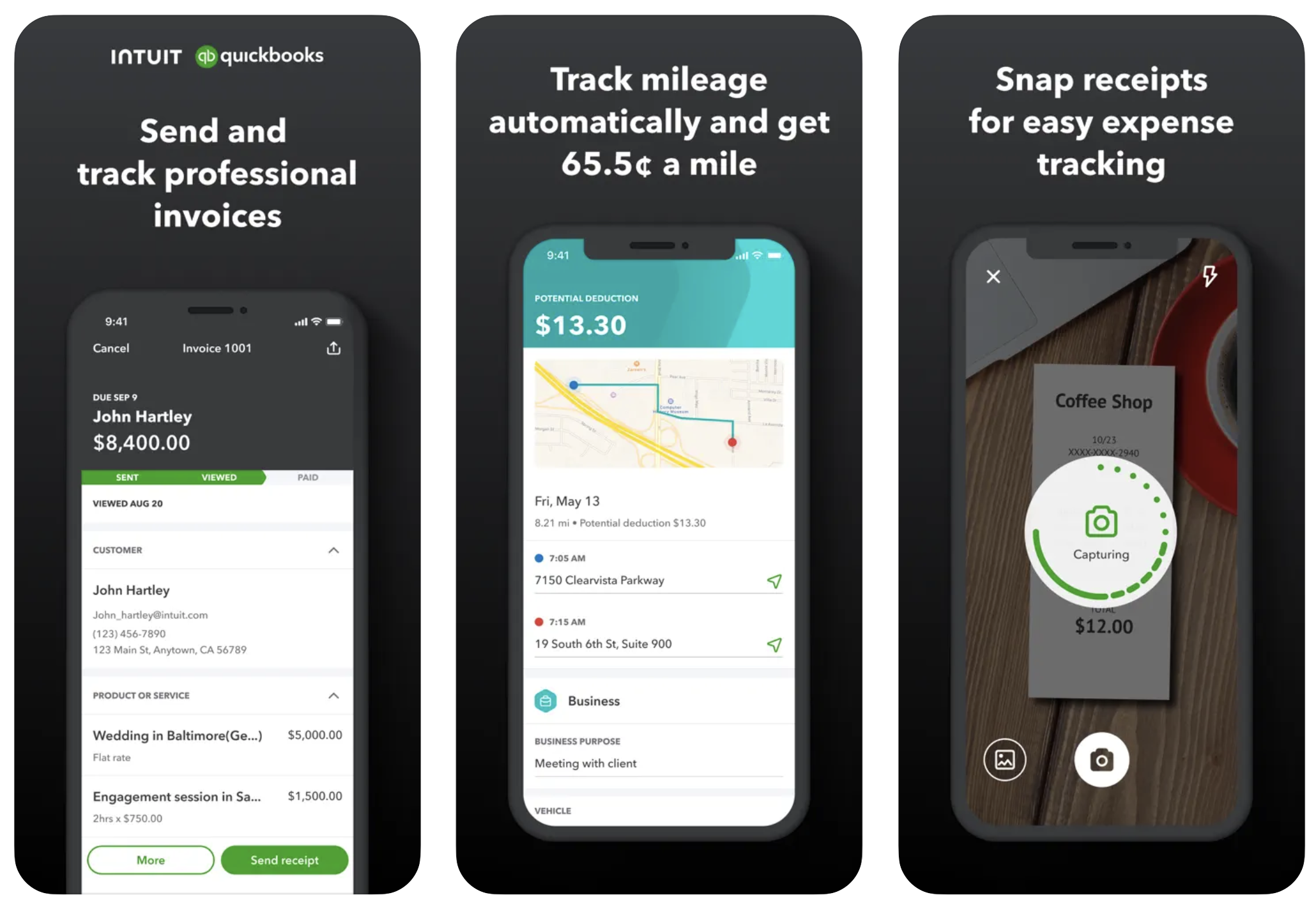

QuickBooks

Picture Credit: QuickBooks

QuickBooks is an easy service that helps you get a full overview of your corporation’s funds by monitoring your corporation bills, earnings, profitability, taxes and extra. The service helps you not solely funds, but additionally handle the accounting duties which are related along with your startup or enterprise. You may see revenue at a look, pay your group, handle your cash, settle for funds and monitor and handle your time.

The service options an easy-to-navigate dashboard that allows you to simply perceive your corporation’s monetary well being. QuickBooks additionally affords tax preparation options, and offers you the flexibility to seek the advice of with consultants that will help you prepare for tax time. QuickBooks has three pricing tiers beginning at $30 monthly.

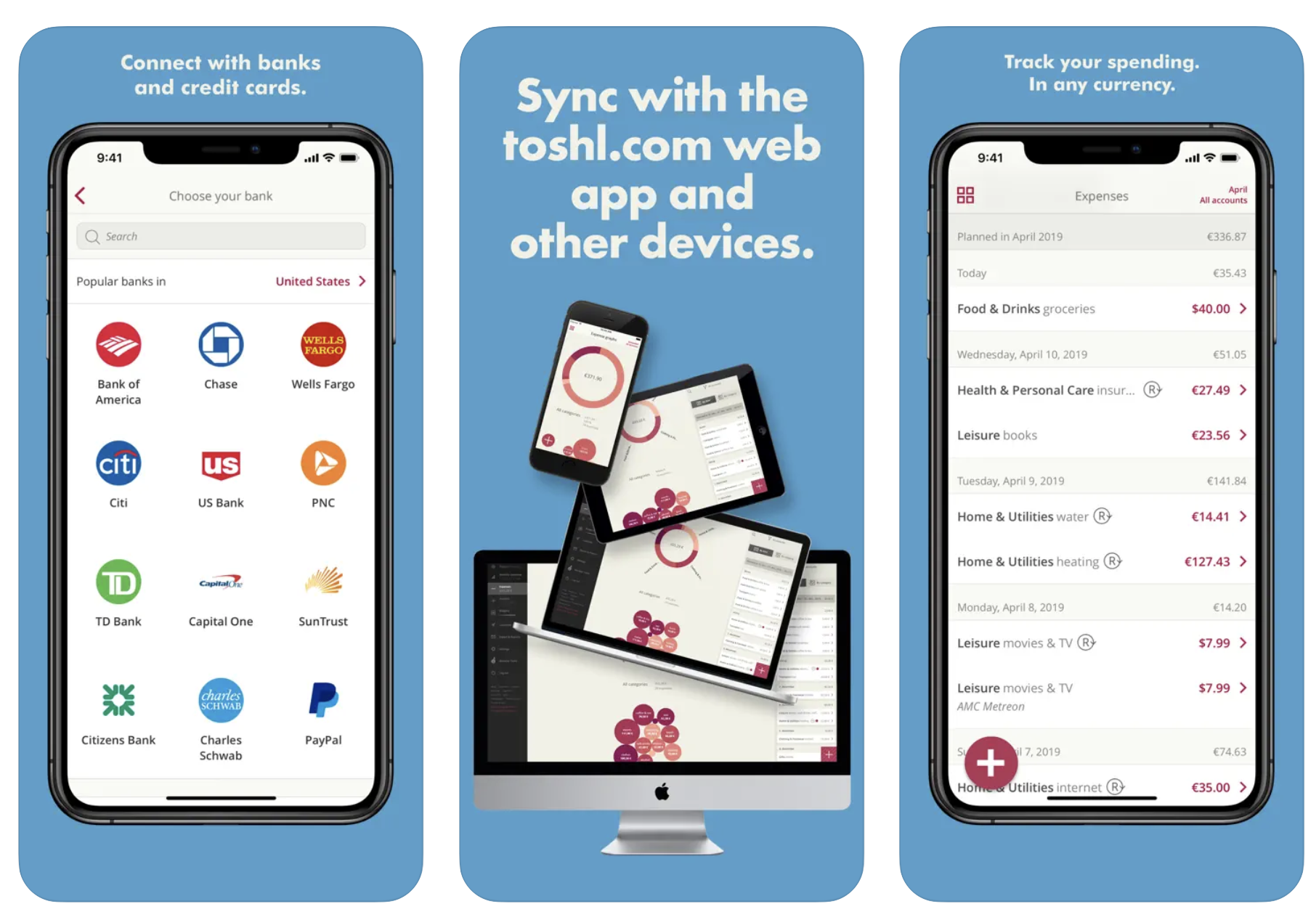

Toshl

Picture Credit: Toshl

If you need a fairly priced and easy, however efficient, budgeting device, Toshl often is the app for you. Though it’s marketed as a private budgeting app, Toshl generally is a good device for brand new startups seeking to perceive and handle their funds for a fraction of the price of budgeting apps marketed towards small companies.

Toshl encompasses a user-friendly intuitive expertise that allows you to create a funds and monitor bills. If you wish to funds for one thing specifically, you’ll be able to set the funds to trace solely bills with explicit classes, tags or monetary accounts. Budgets might be set month-to-month, weekly, every day or for a customized interval of your selecting. The service has a free model and a paid model that prices $4.99 monthly.

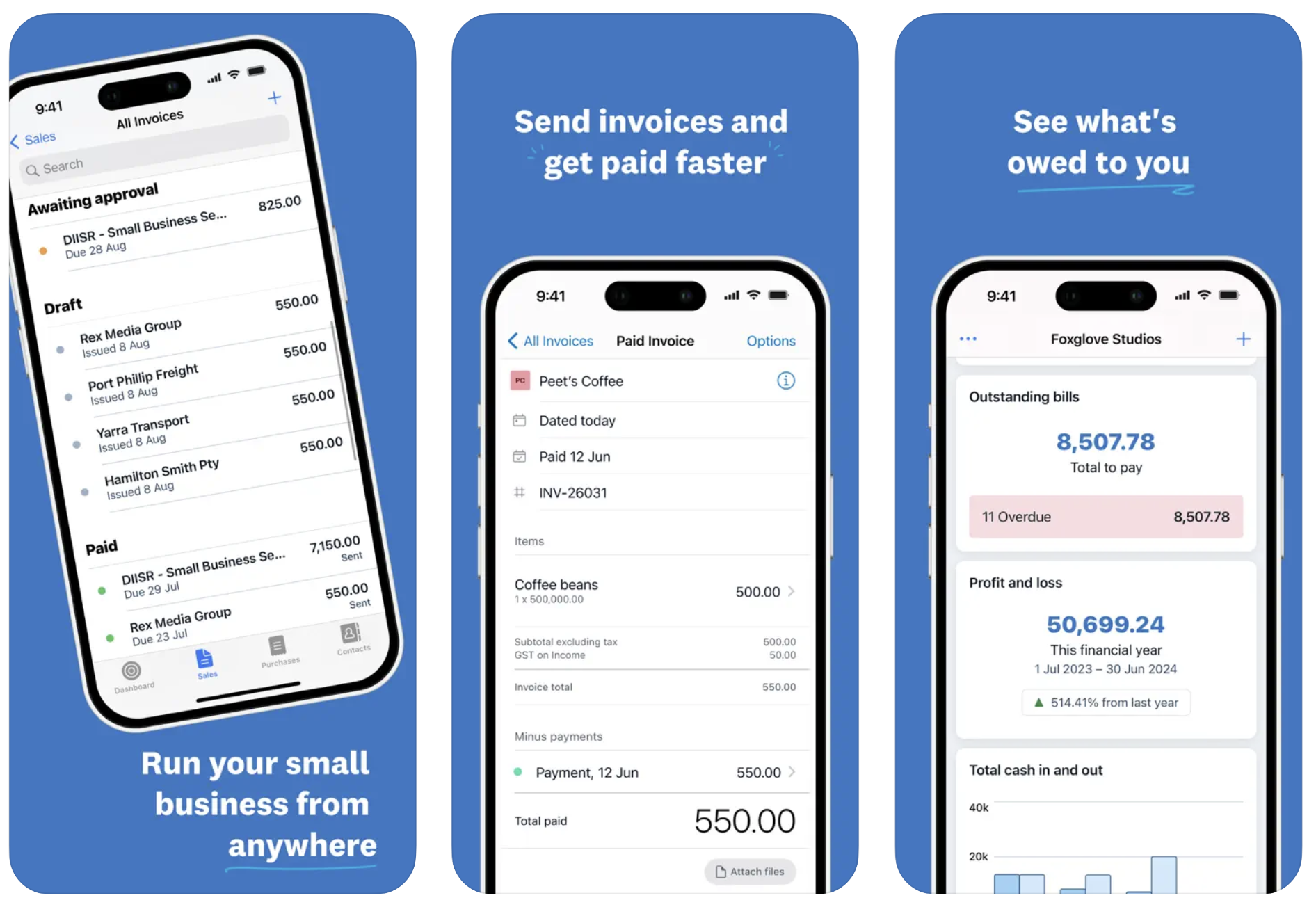

Xero

Picture Credit: Xero

Xero is an effective budgeting and finance device for companies and startups which are prepared for progress. The service’s Finances Supervisor worksheet permits you to create an total funds for every of your monitoring classes. There are additionally different instruments that allow you to see short-term money stream and enterprise snapshots.

You should utilize Xero to ship invoices and quotes, pay payments, monitor tasks, handle bills, settle for funds and extra. Xero is designed to assist small companies make choices utilizing pattern evaluation and easy reporting. Along with monetary options, Xero consists of options that assist with stock and mission administration. The service affords three paid tiers, beginning at $15 monthly.

[ad_2]