[ad_1]

Google Pockets will lastly launch in India — practically two years after its relaunch as a digital pockets platform within the U.S. — based on a preview of the app that the corporate by accident posted on the Google Play retailer within the nation.

After TechCrunch noticed the itemizing for the app — which is able to let customers load up loyalty playing cards and purchase issues, amongst different options — the corporate declined to substantiate that it is going to be coming quickly to Android customers. Nevertheless it then seem to drag a number of the particulars from the itemizing, reminiscent of what look like high-profile launch companions native to India. (The app now extra generically options U.S. manufacturers.)

Considerably confusingly, Google did verify to us that it’s going to proceed to run Google Pay as a standalone app within the nation, not less than for now. That’s a special technique from nearly each different market, the place Google has been merging Pockets and Pay experiences collectively below a single Pockets app.

“Whereas we don’t have something new to share proper now, we’re at all times working to carry extra comfort to individuals’s digital experiences in India. We’re persevering with to put money into the Google Pay app to present individuals straightforward, safe entry to digital funds,” a Google spokesperson stated in a press release to TechCrunch.

We perceive that a part of the rationale appears to be that Google Pay is already large within the nation — it’s largely understood that India is Google’s largest market globally for funds, and it’s the second-largest cost app after PhonePe.

Not least as a result of Google has confirmed its plans to proceed to supply Google Pay as its cost service in India, the Indian model of Google Pockets is predicted to vary from that of the U.S. For one, Google is seeking to present native integrations on the Pockets app within the nation, which homes its largest Android consumer base.

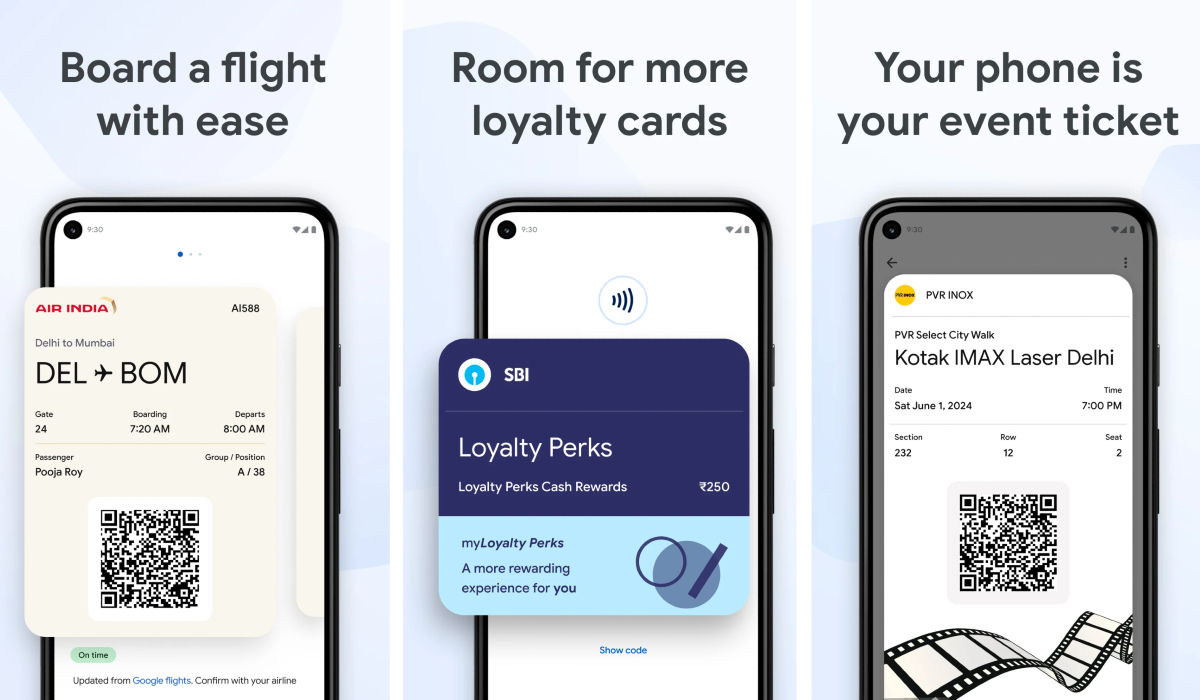

The Google Pockets itemizing that TechCrunch noticed final week featured screenshots of Indian airline Air India, state-owned financial institution State Financial institution of India and multiplex chain PVR Inox, suggesting that loyalty factors could be picked up and used by means of these manufacturers. (Shortly after TechCrunch reached out to Google for remark, Google up to date the itemizing with U.S. manufacturers.)

Picture Credit: Google Play Retailer screenshots

The current Google Pockets app is just not out there but for obtain by means of the Play Retailer in India, nevertheless it has been working for some Android customers within the nation for a while, as reported by the Indian outlet Beebom. Nonetheless, performance is proscribed: customers can add credit score and debit playing cards for contactless funds, however the app doesn’t help any Indian companies and native loyalty packages.

These newest modifications cap off a number of bouncing Google has been doing between numerous monetary providers and differently-branded apps. Google Pockets was launched as the corporate’s cost resolution manner again in 2011. Then, Google launched Android Pay. Then, it tried to switch the Pockets and its Android Pay app with Google Pay. In 2022, Google relaunched the Pockets app as its digital pockets platform for Android, Put on OS and Fitbit OS. Nonetheless, in February this 12 months, the search big introduced it could exchange Google Pay with the Pockets app within the U.S.

Not like its U.S. model, Google Pay in India makes use of the Indian government-backed framework Unified Funds Interface (UPI) to allow funds. That is one cause why Google Pay is completely different in India, and in addition one cause why it’d select to proceed giving customers a separate choice if they’re already utilizing it.

Google Pay is the second most used UPI app in India after Walmart’s PhonePe, giving Google an obvious cause to proceed to help it whereas providing digital wallet-related experiences by means of the Pockets app. The Google Pay app initiated greater than 5 billion transactions valued at over $83 billion in March, per the information posted by the UPI-parent group Nationwide Funds Company of India.

[ad_2]