[ad_1]

A brand new report highlights the demand for startups constructing open supply instruments and applied sciences for the snowballing AI revolution, with the adjoining knowledge infrastructure vertical additionally heating up.

Runa Capital, the enterprise capital (VC) agency that upped sticks from Silicon Valley and moved its HQ to Luxembourg in 2022, has printed the Runa Open Supply Startup (ROSS) Index for the previous 4 years, shining a light-weight on the fastest-growing industrial open supply software program (COSS) startups. The corporate publishes quarterly updates, nevertheless final yr it produced its first annual report taking a top-down view of the entire of 2022 — one thing it’s repeating now for 2023.

Developments

Information is carefully aligned with AI as a result of AI depends on knowledge for studying and making predictions, and this requires infrastructure to handle the gathering, storage, and processing of that knowledge. And these tangential developments collided on this report.

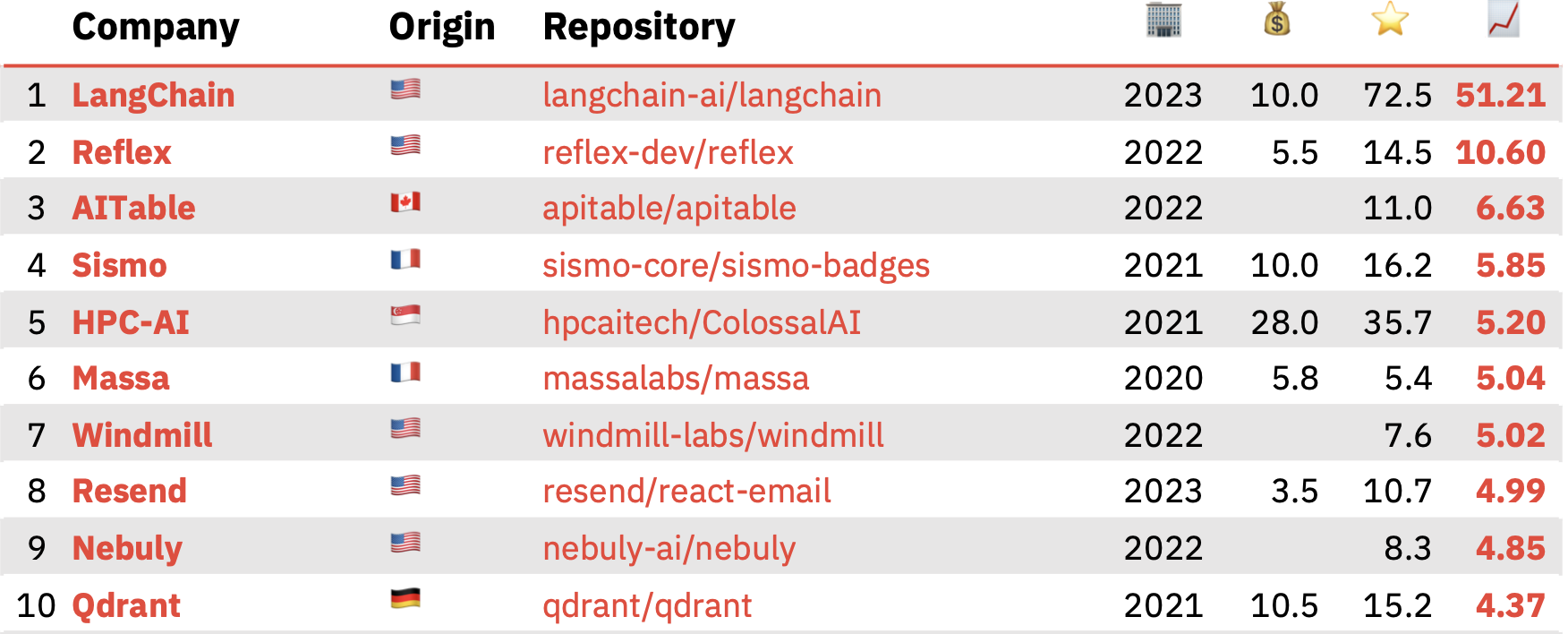

Hitting top-spot within the ROSS Index for final yr was LangChain, a two-year-old San Francisco-based startup that has developed an open supply framework for constructing apps based mostly on giant language fashions (LLMs). The corporate’s major undertaking handed 72,500 stars in 2023, with Sequoia occurring to lead a $25 million Sequence A spherical into LangChain simply final month.

High 10 COSS startups within the ROSS Index for 2023 Picture Credit: Runa Capital

Elsewhere within the high 10 is Reflex, an open supply framework for creating internet apps in pure Python, with the corporate behind the product not too long ago securing a $5 million seed funding; AITable, a spreadsheet-based AI chatbot builder and one thing akin to an open supply Airtable competitor; Sismo, a privacy-focused platform that permits customers to selectively disclose private knowledge to functions; HPC-AI, which is constructing a distributed AI improvement and deployment platform in a push to turn into one thing just like the OpenAI of Southeast Asia; and open supply vector database Qdrant, which not too long ago secured $28 million to capitalize on the burgeoning AI revolution.

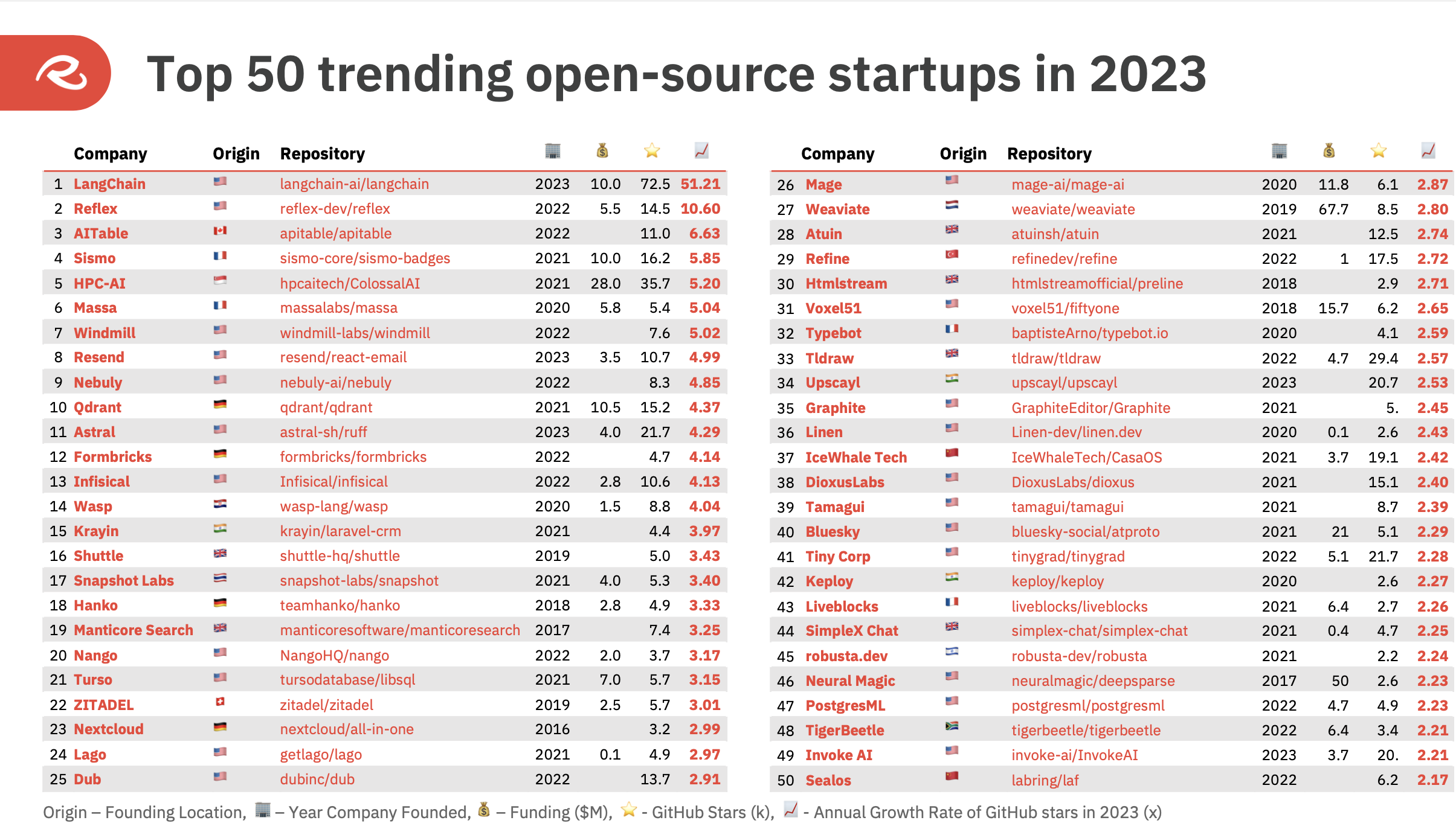

A broader have a look at the “high 50 trending” open supply startups final yr reveals that greater than half (26) are associated to AI and knowledge infrastructure.

High 50 COSS startups within the ROSS Index for 2023 Picture Credit: Runa Capital

It’s tough to correctly examine the 2023 index with the earlier yr from a vertical perspective, due largely to the truth that companies typically pivot or change their product-positioning to go well with what’s scorching right now. With the ChatGPT hype prepare going full throttle final yr, this may occasionally have led earlier-stage startups to change their focus, and even simply place higher emphasis on the present “AI” ingredient of their product.

However as generative AI’s breakthrough yr, it’s simple to see why demand for open-source componentry would possibly skyrocket, as firms of all sizes look to maintain apace with proprietary AI juggernauts similar to OpenAI, Microsoft, and Google.

Geographies

Open supply software program has additionally at all times been very distributed, with builders from everywhere in the world contributing. This ethos typically interprets into industrial open supply startups which could not have a conventional middle of gravity anchored by a brick-and-mortar HQ.

Nevertheless, the ROSS Index goes a way towards bringing geography into the image, reporting that 26 firms on the listing have an HQ within the U.S., although 10 of those firms originated elsewhere and nonetheless have founders or workers based mostly in different locales.

In complete, the highest 50 hailed from 17 separate nations, with 23 of the businesses included in Europe — a 20% rise on the earlier yr’s index. France counted probably the most COSS startups with seven, together with Sismo and Massa that are within the high 10, whereas the U.Ok. soared from only one startup in 2022 to 6 in 2023, inserting it in second place from a European perspective.

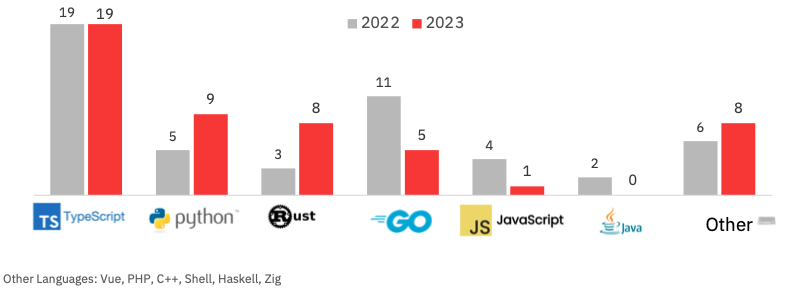

Different notable tidbits to emerge from the report embrace programming languages — the ROSS Index recorded 12 languages utilized by the highest 50 final yr, versus 10 in 2022. However Typescript, a JavaScript superset developed by Microsoft, remained the preferred, utilized by 38% of the highest 50 startups. Each Python and Rust grew in reputation, with Go and JavaScript dropping.

ROSS Index: Trending programming languages. Picture Credit: Runa Capital

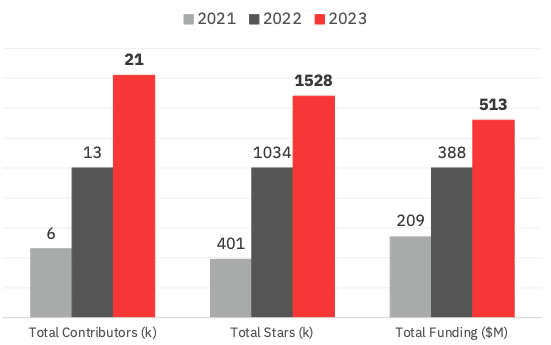

The highest 50 ROSS Index members collectively gained 12,000 contributors in 2023, whereas the general GitHub star-count elevated by almost 500,000. The index additionally reveals that funding into the highest 50 COSS startups final yr hit $513 million, a rise of 32% on 2022 and 145% on 2021.

ROSS Index: Contributors, stars, and funding Picture Credit: Runa Capital

Methodology & context

It’s value wanting on the methodology behind all this — what components affect whether or not an organization is taken into account “high trending”? For starters, all firms included will need to have no less than 1,000 GitHub stars (a GitHub metric much like a “like” in social media) to be thought of. However star-count alone doesn’t inform us a lot about what’s trending, provided that stars are collected over time — so a undertaking that has been on GitHub for 10 years is prone to have collected extra stars than one which has existed for 10 months. As an alternative, Runa measures the relative progress of the celebs over a given interval utilizing an annualised progress fee (AGR) — this appears on the star worth now versus a earlier corresponding interval to see what has grown most impressively.

A level of handbook curation is concerned right here, too, provided that the objective is to eke out open supply “startups” particularly — so the Runa funding crew pulls out initiatives that belong to a “product-focused industrial group,” and it has to have been based fewer than ten years in the past with lower than $100 million in identified funding.

Defining what constitutes “open supply” has its personal inherent challenges too, as there’s a spectrum of how “open supply” a startup is — some are extra akin to “open core,” the place most of their main options are locked behind a premium paywall, and a few have licenses that are extra restrictive than others. So for this, the curators at Runa determined that the startup should merely have a product that’s “reasonably linked to its open-source repositories,” which clearly includes a level of subjectivity when deciding which of them make the minimize.

There are additional nuances at play too. The ROSS Index adopts a very liberal interpretation of “open supply” — for instance, each Elastic and MongDB deserted their open supply roots for licenses which are “supply obtainable,” to guard themselves from being taken benefit of by the key cloud suppliers. In accordance with the ROSS Index’s methodology, each these firms would qualify as “open supply” — regardless that their licenses usually are not formally permitted as such by the Open Supply Initiative, and these particular instance firms not discuss with themselves as “open supply.”

Thus, based on Runa’s methodology, it makes use of what it calls the “industrial notion of open-source” for its report, relatively than the precise license the corporate attaches to its undertaking. Which means that restricted source-available licenses like BSL (enterprise supply license) and SSPL (server facet public license), which MongoDB launched as a part of its transition away from open supply in 2018, are very a lot on the menu so far as industrial firms within the ROSS Index is anxious.

“Such licenses keep the OSS spirit — all its freedoms, aside from barely restricted redistribution, which doesn’t have an effect on builders however grants authentic distributors a long-term aggressive edge,” Konstantin Vinogradov, Runa Capital’s London-based common associate, defined to TechCrunch. “From a VC perspective, it’s simply an advanced playbook for precisely the identical sort of firms. The open supply definition applies to software program merchandise, not firms.”

There are different notable filters in place too. As an example, firms which are principally targeted on offering skilled providers, or side-projects with restricted lively assist or with no industrial ingredient, usually are not included within the ROSS Index.

For comparative functions, there are different indexes and lists on the market that give a steer on the “whats scorching” within the open supply panorama. One other VC agency referred to as Two Sigma Ventures maintains the Open Supply Index, for example, which has similarities in idea to Runa’s, besides it spans all method of open supply initiatives (not simply startups) and has further filters in place, together with the flexibility to view by GitHub’s “watchers” metric, which some argue offers a extra correct image of a undertaking’s true reputation.

GitHub itself additionally publishes a trending repositories web page, which much like Two Sigma Ventures, doesn’t concentrate on the enterprise behind the undertaking.

So the ROSS Index has emerged as a helpful complementary software for determining which open supply “startups” particularly are value preserving tabs on.

[ad_2]