[ad_1]

African monetary establishments usually scale their options utilizing a mixture of native and overseas tech. Appzone is likely one of the standout native fintech software program suppliers for banks and fintechs, offering higher pricing and suppleness.

For over a decade, the Nigeria-based Appzone has functioned as an enabler (at fee rails and core infrastructure) inside banking and funds, constructing customized software program and software-as-a-service merchandise for over 18 industrial banks and greater than 450 microfinance banks throughout Africa, together with Ghana and Kenya.

In 2022, the fintech software program supplier, based by Emeka Emetarom, Obi Emetarom and Wale Onawunmi, determined to self-innovate by delving into blockchain know-how and integrating it with legacy banking and fee methods. As such, it rebranded to Zone, a licensed blockchain-enabled fee infrastructure firm–and carved out its unique banking-as-a-service enterprise right into a separate standalone firm, Qore. At present, Zone, its blockchain community that permits funds and acceptance of digital currencies, is asserting that it has raised $8.5 million in a seed spherical.

Zone’s idea is simple: It acknowledges that Africa’s present fee infrastructure will not be appropriate for transitioning to a cashless future (which can take a while). Subsequently, the fintech is creating an interoperable fee infrastructure utilizing blockchain know-how — recognized for its skill to scale infinitely — to attach banks and fintech corporations, facilitating transaction movement with out intermediaries.

In an interview with TechCrunch, CEO Obi Emetarom says Zone is Africa’s first regulated blockchain community for funds and has already signed up over 15 of the continent’s largest banks. It’s presently processing home transactions for seven of those banks by ATM channels, considered one of a number of fee channels by which transactions originate in Nigeria, together with POS, fund switch, internet and direct debit.

In accordance with the chief government, eight banks are at numerous phases of implementation as onboarding processes can take as much as six months resulting from inner procedures comparable to establishing staging environments, testing and acquiring administration approvals.

Zone, earlier than its launch, obtained a switching license from the Central Financial institution of Nigeria (CBN), the nation’s apex financial institution, tapping into Nigeria’s central change (Nigeria Inter-Financial institution Settlement System), which is answerable for the interoperability between numerous gamers within the nation’s monetary system and the swift motion of cash between financial institution accounts.

Because the central change primarily handles fund switch switching, a number of fintechs, like Moniepoint and OPay, have used direct card routing (DCR) to determine direct connections with card issuers, resulting in quicker transactions with fewer failures for POS transactions, which is Zone’s subsequent focus.

“We’re launching and rolling out some new use instances this 12 months. The ATM use case didn’t incorporate fintechs as a result of they don’t deploy ATMs,” mentioned Emetarom. “However with the POS, that brings a use case fintechs are very acquainted with – and for that, we’re additionally integrating a number of the massive fintechs within the nation.”

Emetarom explains that Zone goals to empower banks and fintechs to duplicate the achievements of OPay and Moniepoint with out the need for particular person integrations. Zone already has these integrations in place and operates as a licensed change, thus avoiding the chance of violating regulatory pointers, he mentioned. The blockchain structure, he added, is such that when a fintech connects to the Zone community, it is supplied with a gateway that serves because the surroundings by which its transactions are despatched on to the financial institution, to the issuer for authorization, and again.

“The financial institution or fintech turns into a change as a result of they now have one thing of their surroundings that connects them to all of the locations they should attain fairly than going by a third-party change,” the CEO notes. “So the reliability goes up considerably as a result of we dont have any situation the place they should depend on a center middleman and the fintech has management over their change as a result of it’s sitting of their surroundings on their servers or the cloud.”

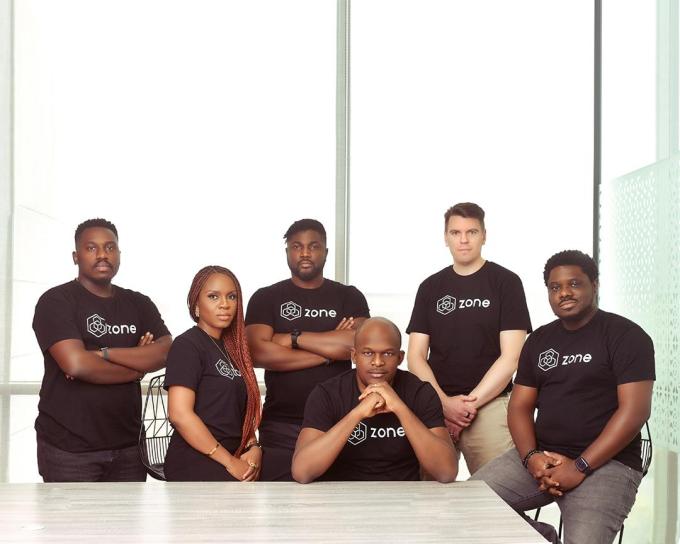

The Zone workforce

Emetarom said that reconciliation and prompt settlement are different imminent functions of Zone’s blockchain know-how.

As an example, when a transaction fails and a buyer is debited, a prolonged reconciliation course of follows earlier than a refund is issued, typically taking days or perhaps weeks. Zone’s decentralized structure will enable for computerized reconciliation and adjustment when discrepancies happen, resulting in fast refunds for patrons with no need them to report the problem. As well as, its blockchain know-how ought to present transparency, permitting the terminal and the issuer full visibility into the transaction standing.

Equally, retailers expertise settlement delays after they obtain funds; with Zone’s prompt settlement characteristic, funds can be delivered to the service provider’s financial institution instantly after the transaction, addressing liquidity challenges and guaranteeing smoother operations.

“Decentralized routing improves reliability and scalability and offers automated reconciliation to resolve chargeback fraud. With Zone, we will harmonize transaction processing and the settlement system, which can be supported by a settlement token,” mentioned the CEO, including that these functionalities can be rolled out pending approval from the CBN.

The funds change and monetary community panorama in Africa usually depend on financial institution consortiums for infrastructure possession. Personal initiatives have seen blended success, with few gaining vital traction outdoors conventional banking; Zone being considered one of them, stands out resulting from its skilled founders, a reside processing consumer base, and central financial institution licensing.

To this point, Zone has processed transactions at greater than 6,000 ATMs for greater than 10 million cardholders. The fintech processed over $1 million inside the first three months of launching the ATM use case.

This traction has garnered pleasure amongst its buyers. Flourish Ventures, a world fintech-focused fund, and TLcom Capital, a pan-African enterprise capital fund, led the funding spherical, which the startup says will help it in launching further functionalities in addition to broaden its community protection to different fee channels, thereby catering to a wider vary of shoppers. As well as, the corporate, which doesn’t cost implementation charges, hopes to scale back the time it takes to onboard its shoppers (fintechs and banks) within the coming months.

“For the primary time in Africa, Zone’s know-how permits direct communication between individuals within the fee ecosystem. We imagine it is a basic leap that can enable clients to expertise a very new commonplace of reliability, pace, and value effectivity at ATMs, POS machines, and on-line,” mentioned Ameya Upadhyay, a associate at Flourish Ventures.

“We’re excited by the potential for Zone’s know-how to be replicated throughout borders to advance fee innovation globally. The truth that Zone is led by Obi and Wale, who’re veterans of the banking trade, reinforces our conviction that Zone can fulfill our shared purpose of shifting your complete sector ahead.”

[ad_2]