[ad_1]

There are two industries that make a ton of cash however they’re historically largely ignored by enterprise capital — motion pictures and gaming. That comes as a little bit of a shock to many: Enterprise capitalists are recognized for his or her eager eye on high-growth alternatives, predominantly casting their lot with tech startups, healthcare improvements, and the subsequent large factor within the digital sphere. However Deadline stories that motion pictures made $33.9 billion final yr, and international gaming income was $184 billion, in accordance with Newzoo. Nonetheless, the proposition of investing in motion pictures introduces enterprise capitalists to a panorama far faraway from the calculable metrics of SaaS platforms or the comparatively predictable danger of biotech.

Gaming and films are extraordinarily hit and miss, and that’s the form of unpredictability that’s seldom embraced by conventional enterprise capital funding theses.

I’m at all times notably interested in pitch decks within the gaming trade, so when SuperScale threw its hat within the ring, I used to be excited. The corporate is promising to make advertising for video games simpler, and provided that nice advertising is among the essential variations between an okay end result and a smash-hit success, it tickled my curiosity nerve in a most pleasant manner.

We’re on the lookout for extra distinctive pitch decks to tear down, so if you wish to submit your individual, right here’s how you are able to do that.

Slides on this deck

The corporate submitted a 22-slide deck, however “particulars of shoppers and buyer case research the place we didn’t get approval for distribution are redacted,” in accordance with the corporate.

- Cowl slide

- Drawback slide

- Answer slide

- Macro market measurement prediction slide

- Market measurement prediction slide

- Market measurement slide (2027)

- Goal buyer slide

- Platform interstitial slide

- The way it works slide

- Market segmentation slide

- Enterprise mannequin slide

- Case research slide

- Aggressive panorama slide

- Marketing strategy interstitial slide

- 5-year plan abstract slide

- The Ask slide

- Use of Funds abstract slide

- Abstract slide

- Workforce slide

- Appendix interstitial slide

- Firm historical past slide

- Closing/contact slide

Three issues to like about SuperScale’s pitch deck

SuperScale has an extremely slick-looking deck that will get proper to the purpose. Twenty-two slides would possibly seem to be too many (the optimum size for a slide deck is round 16 slides as of late), however there are some interstitial slides and an appendix on this one, and people don’t really matter.

Let’s check out among the issues that actually work.

Making your individual market

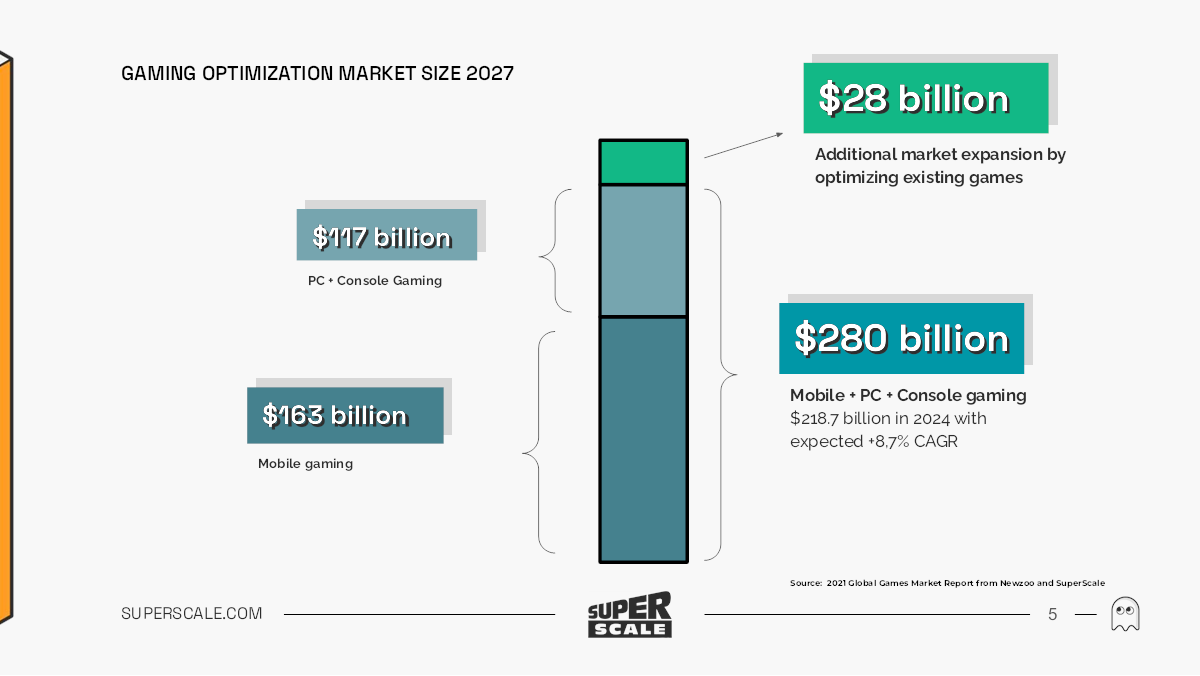

[Slide 5] This can actually catch the attention of buyers. Picture Credit: SuperScale

Gaming is a big market, and buyers don’t have to be satisfied of that. The query, then, is tips on how to get a slice of that very tasty digital pie. SuperScale is taking some attention-grabbing leaps of religion right here: The numbers are projections for 2027, moderately than speaking concerning the numbers as we speak. However this slide comes early within the deck; if SuperScale could make a stable argument for a way will probably be a part of the machine that grows gaming by 10%, that’s very attention-grabbing certainly.

It’s daring and brazen storytelling. After all, the corporate is now setting itself up for having to share a plan and present the receipts, nevertheless it’s a great way to get buyers proper off the bat.

A brand new lease on life

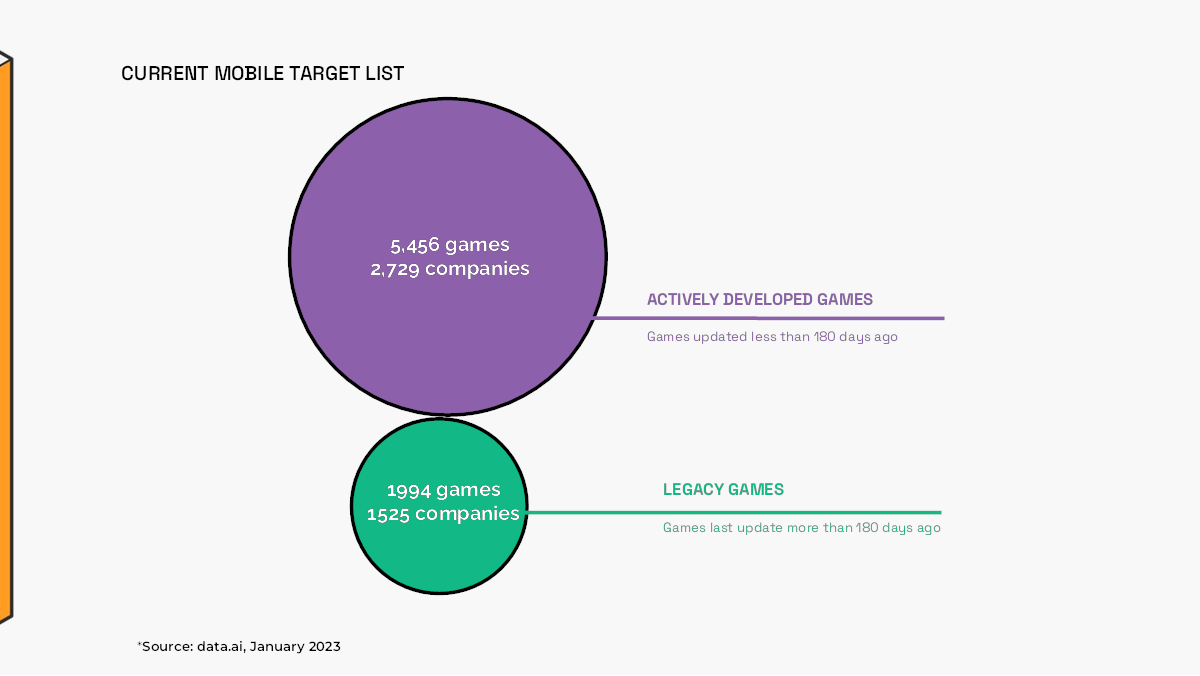

[Slide 7] SuperScale guarantees to go after two markets. Picture Credit: SuperScale

As a video games optimization firm, SuperScale has an attention-grabbing strategy, and this easy slide holds a wise promise: What if we will massively improve the profitability of a recreation that’s already on the market? SuperScale’s mannequin goals, partly, to offer these video games a brand new lease on life at a stage of the video games publishing cycle the place each greenback that is available in is mainly a bonus. The deck isn’t making an enormous deal out of this, however I can see that being a very highly effective gross sales approach to video games studios — and if it’s profitable with legacy video games (at basically no danger), wouldn’t it’s good to combine SuperScale on new video games, too?

It’s extraordinarily good, and buyers will be capable of see that, too.

That’s the way you do a abstract

Design and almost-unreadable textual content apart, the content material on this slide is nice:

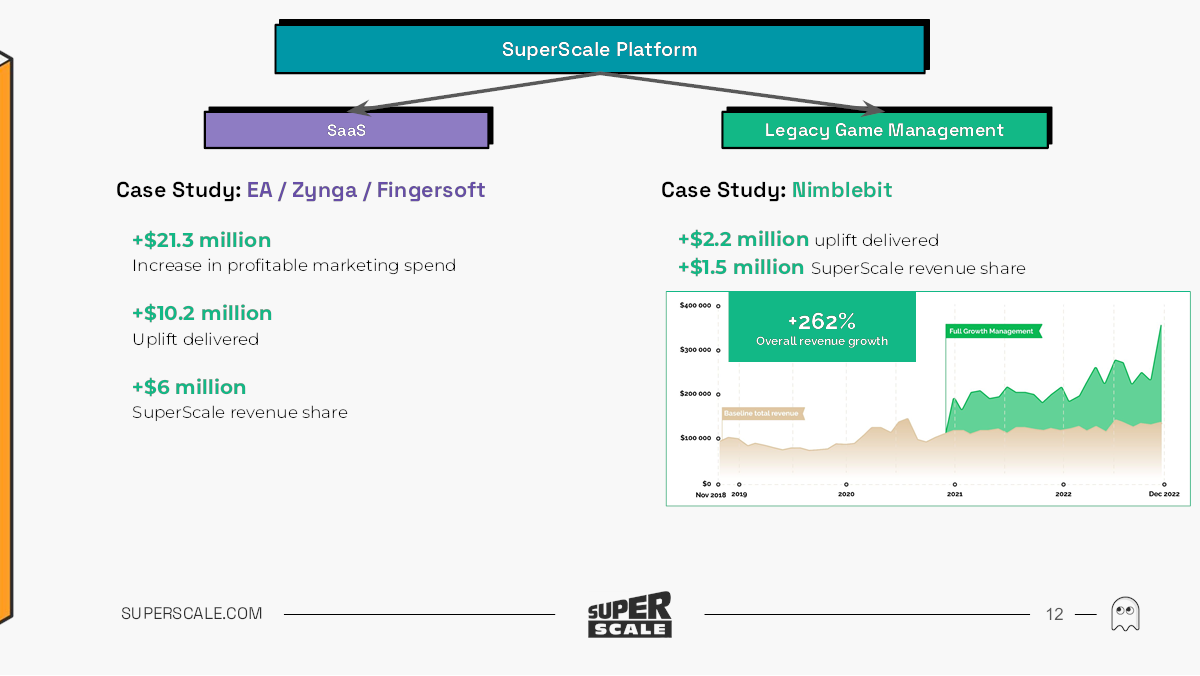

[Slide 18] Hell sure. Picture Credit: SuperScale

I really like a superb abstract slide. Give the buyers all of the pondering and speaking factors they should get enthusiastic about an funding. It’s an ideal strategy.

Three issues that SuperScale might have improved

Total, this is among the higher pitch decks I’ve seen, however there are some things that made me go “hmm.”

Wait, how large is your crew?

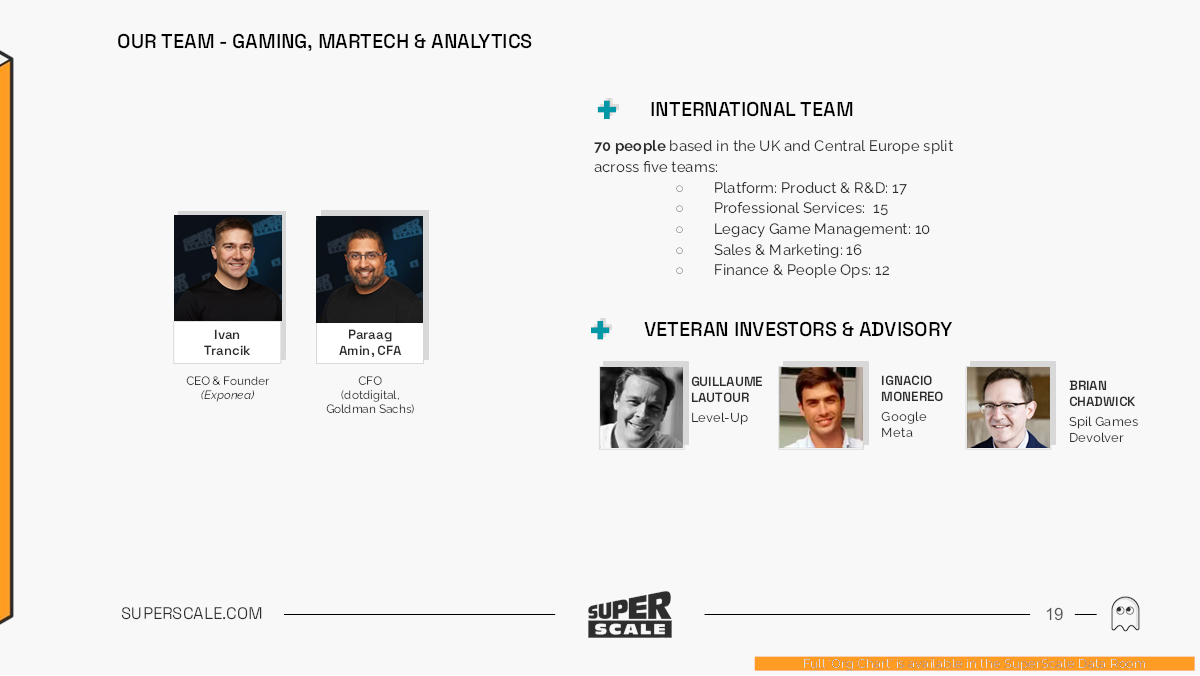

When an organization raises round $5 million, I usually anticipate a crew of 10 to fifteen. This crew slide got here as a little bit of a shock:

[Slide 19] That’s an enormous crew. Picture Credit: SuperScale

Placing this slide on the finish of the deck makes me surprise concerning the seriousness of this startup. If it has 5 enterprise items and 70+ crew members, it throws the remainder of the deck out of whack. There’s an ask slide, however no stable use of funds. You possibly can’t maintain a 70-person crew with out having important income. The corporate is spending a lot time speaking about 2027 and its five-year plans, but it completely glosses over how a lot cash it’s making.

There’s some data about income, however solely within the type of case research:

[Slide 12] Blink and also you’ll miss it, however this slide consists of some essential enterprise metrics. Picture Credit: SuperScale

Did you notice it? SuperScale made $6 million from EA, Zynga and Fingersoft. And a further $1.5 million from NimbleBit.

That’s spectacular, nevertheless it’s a horrible manner of displaying off this stage of traction. A correct traction slide would show these numbers not as totals, however as income graphs that present how a lot and how briskly income is rising over time.

Why is SuperScale elevating cash?

It’s complicated why the corporate is elevating round $5 million when it’s making correct income numbers.

[Slide 16] What? Picture Credit: SuperScale

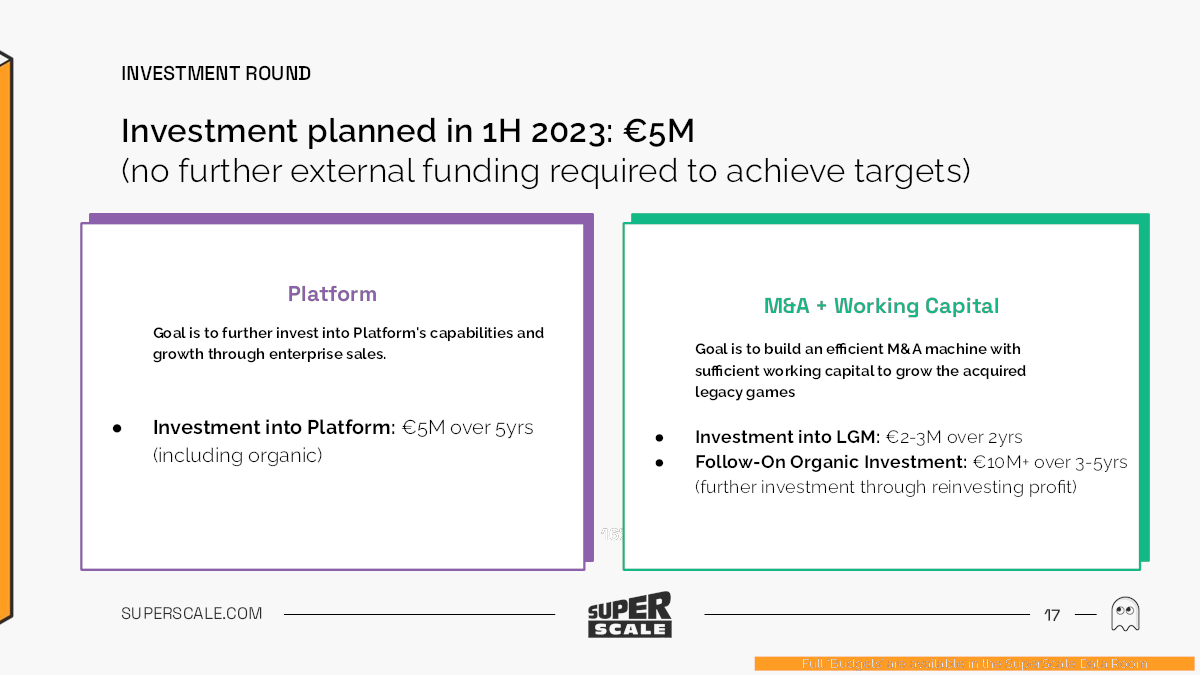

This slide makes nearly no sense in any respect. On slide 12, the corporate famous it had $7.5 million price of income from simply its case examine purchasers. What number of purchasers are there? We don’t know. How a lot income is there in complete? No thought. And what’s it planning on doing with the cash? Effectively, there’s a slide for that:

[Slide 17] Elevating for a five-year runway? Picture Credit: SuperScale

This slide is nugatory. The corporate says it’s constructing an M&A machine, suggesting it’s planning to accumulate the rights to legacy video games and presumably develop them. That’s superior and all, however there must be a selected plan for that.

There’s additionally the inner inconsistencies right here: It says it wants $5 million to realize targets, however then says it can have “observe on natural funding” by way of reinvesting income.

Within the M&An area, $5 million is nearly no cash in any respect, so now I’m very interested in who the acquisition targets could be, and the way the corporate presumes these acquisitions will work towards its backside line.

Inform a coherent story!

SuperScale, on first read-through, appeared like such a incredible funding alternative, however as I began poking and prodding on the deck, it made much less and fewer sense. The corporate appears to need to purchase different firms (or is it video games?). It has 70 individuals on employees, nevertheless it’s solely elevating $5 million. It doesn’t share its previous successes, nor how it’s planning to search out the long run success it wants.

I feel a significantly better manner of telling this story, general, could be to have an end-to-end story, advised persistently:

- We purchased recreation A for $B.

- We invested $C into progress infrastructure for the sport.

- We invested $D into advertising for the sport.

- Income for the sport went from $E to $F, after solely investing $C+D.

- As you’ll be able to see, we made revenue of $X on this mission, and we predict this playbook will work on video games which have this specific profile.

- We need to construct a portfolio of 30 video games, which is why we’re elevating 30*($B+$C+$C), after which this turns into a self-sustainable enterprise with a repeatable playbook and enterprise mannequin.

That story would make sense to buyers.

The total pitch deck

If you need your individual pitch deck teardown featured on TechCrunch, right here’s extra info!

[ad_2]