[ad_1]

In an sudden transfer, Miles Grimshaw introduced right this moment that he’s rejoining Thrive Capital after working as a normal associate at Benchmark for the previous three years.

Grimshaw first joined Thrive, a New York-based enterprise agency that Joshua Kushner based, in 2013. He’s returning as a normal associate.

In a publish on X, Grimshaw stated that was “elated to re-join the group at Thrive” however that he additionally “regarded ahead to persevering with to associate with Benchmark, as Thrive has for a few years.”

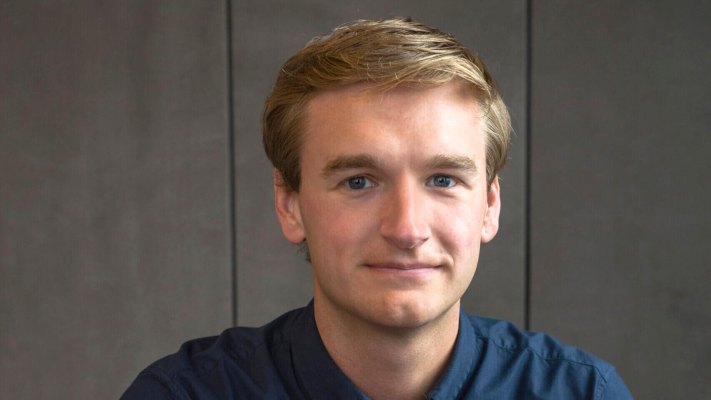

Picture Credit: Thrive Capital

Kushner additionally shared the information on X, declaring that in his earlier time at Thrive, Grimshaw led investments in firms comparable to Airtable, Monzo (which raised one other $430 million right this moment), Lattice and Benchling.

He additionally wrote: “As we look forward to the subsequent chapter of the agency, and the extraordinary wave of innovation that lies forward, Miles has a uncommon set of traits that make him a formidable associate to our founders.”

TechCrunch has reached out to each Grimshaw and Thrive for remark.

When becoming a member of storied enterprise agency Benchmark in December of 2020, then-29-year-old Miles Grimshaw grew to become its fifth normal associate. He had equally joined a group of 4 different companions at Thrive again in 2013.

The Monetary Occasions reported in January that Thrive Capital was “getting ready to ask buyers for a minimum of $3bn in contemporary capital after the New York enterprise fund made mammoth bets on expertise start-ups final 12 months.” For instance, Thrive in 2023 put more cash into funds big Stripe in that firm’s $6.5 billion elevate, co-led a $300 million funding into fintech Ramp (at a decrease valuation) and led a $25 million spherical into fintech Clair.

In February 2022, Thrive Capital, which was based in 2009 by a then 25-year-old Kushner, introduced it had closed its eighth fund with roughly $3 billion in capital commitments, $500 million of which it deliberate to put money into early-stage startups and one other $2.5 billion that it had earmarked for later-stage firms.

[ad_2]